Authors

Summary

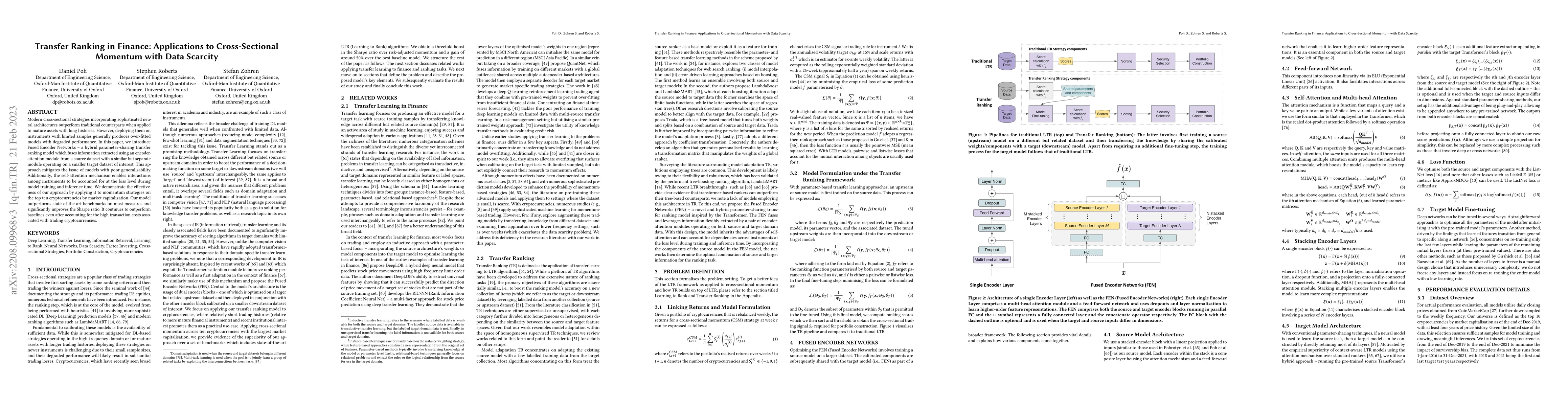

Cross-sectional strategies are a classical and popular trading style, with recent high performing variants incorporating sophisticated neural architectures. While these strategies have been applied successfully to data-rich settings involving mature assets with long histories, deploying them on instruments with limited samples generally produce over-fitted models with degraded performance. In this paper, we introduce Fused Encoder Networks -- a novel and hybrid parameter-sharing transfer ranking model. The model fuses information extracted using an encoder-attention module operated on a source dataset with a similar but separate module focused on a smaller target dataset of interest. This mitigates the issue of models with poor generalisability that are a consequence of training on scarce target data. Additionally, the self-attention mechanism enables interactions among instruments to be accounted for, not just at the loss level during model training, but also at inference time. Focusing on momentum applied to the top ten cryptocurrencies by market capitalisation as a demonstrative use-case, the Fused Encoder Networks outperforms the reference benchmarks on most performance measures, delivering a three-fold boost in the Sharpe ratio over classical momentum as well as an improvement of approximately 50% against the best benchmark model without transaction costs. It continues outperforming baselines even after accounting for the high transaction costs associated with trading cryptocurrencies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSynthetic Data Applications in Finance

Manuela Veloso, Mohsen Ghassemi, Tucker Balch et al.

Cross-Modal Transfer from Memes to Videos: Addressing Data Scarcity in Hateful Video Detection

Roy Ka-Wei Lee, Han Wang, Rui Yang Tan

| Title | Authors | Year | Actions |

|---|

Comments (0)