Yuri F. Saporito

8 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Risk Budgeting Allocation for Dynamic Risk Measures

We define and develop an approach for risk budgeting allocation -- a risk diversification portfolio strategy -- where risk is measured using a dynamic time-consistent risk measure. For this, we intr...

Optimal Trading in Automatic Market Makers with Deep Learning

This article explores the optimisation of trading strategies in Constant Function Market Makers (CFMMs) and centralised exchanges. We develop a model that accounts for the interaction between these ...

Statistical Learning and Inverse Problems: A Stochastic Gradient Approach

Inverse problems are paramount in Science and Engineering. In this paper, we consider the setup of Statistical Inverse Problem (SIP) and demonstrate how Stochastic Gradient Descent (SGD) algorithms ...

Functional Classification of Bitcoin Addresses

This paper proposes a classification model for predicting the main activity of bitcoin addresses based on their balances. Since the balances are functions of time, we apply methods from functional d...

Optimal Trading with Signals and Stochastic Price Impact

Trading frictions are stochastic. They are, moreover, in many instances fast-mean reverting. Here, we study how to optimally trade in a market with stochastic price impact and study approximations t...

Avoiding zero probability events when computing Value at Risk contributions

This paper is concerned with the process of risk allocation for a generic multivariate model when the risk measure is chosen as the Value-at-Risk (VaR). We recast the traditional Euler contributions...

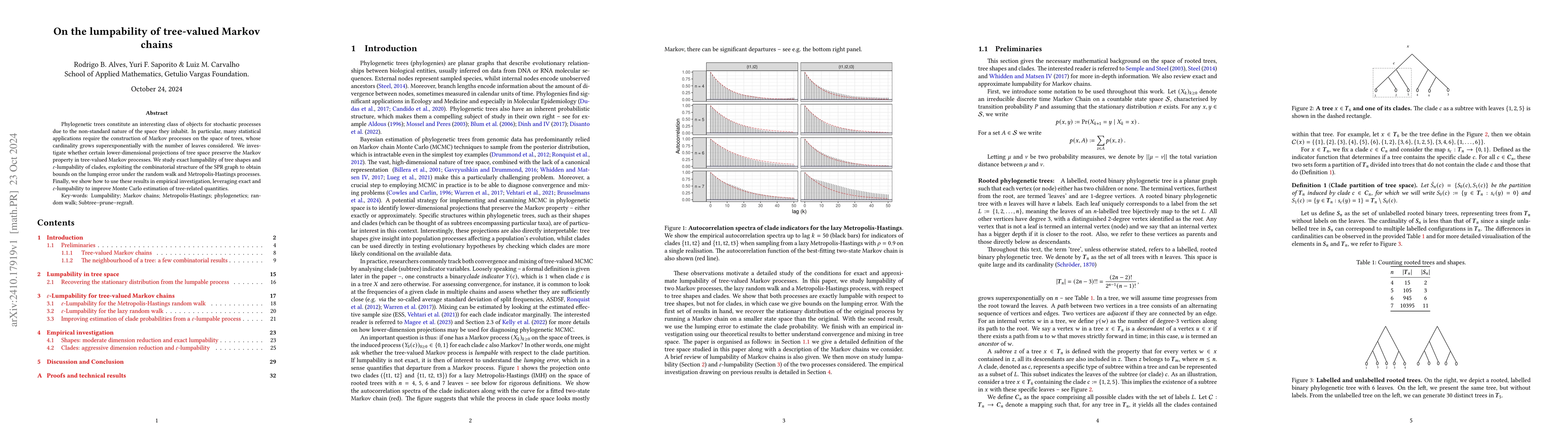

On the lumpability of tree-valued Markov chains

Phylogenetic trees constitute an interesting class of objects for stochastic processes due to the non-standard nature of the space they inhabit. In particular, many statistical applications require th...

Reverse-BSDE Monte Carlo

Recently, there has been a growing interest in generative models based on diffusions driven by the empirical robustness of these methods in generating high-dimensional photorealistic images and the po...