Summary

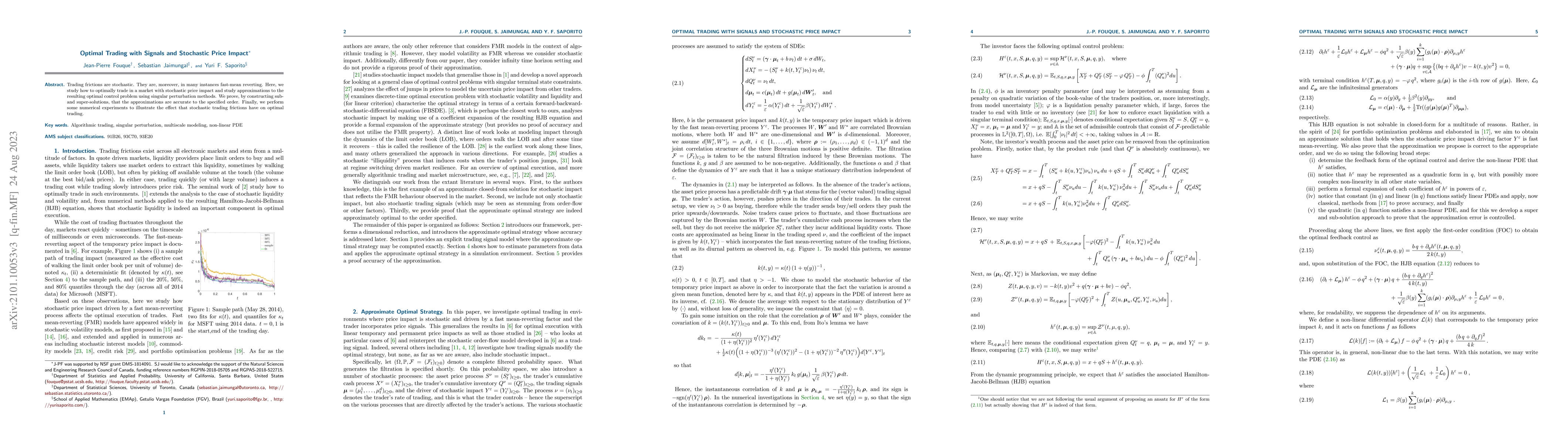

Trading frictions are stochastic. They are, moreover, in many instances fast-mean reverting. Here, we study how to optimally trade in a market with stochastic price impact and study approximations to the resulting optimal control problem using singular perturbation methods. We prove, by constructing sub- and super-solutions, that the approximations are accurate to the specified order. Finally, we perform some numerical experiments to illustrate the effect that stochastic trading frictions have on optimal trading.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)