Jean-Pierre Fouque

13 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Analysis of Multiscale Reinforcement Q-Learning Algorithms for Mean Field Control Games

Mean Field Control Games (MFCG), introduced in [Angiuli et al., 2022a], represent competitive games between a large number of large collaborative groups of agents in the infinite limit of number and...

Convergence of Multi-Scale Reinforcement Q-Learning Algorithms for Mean Field Game and Control Problems

We establish the convergence of the unified two-timescale Reinforcement Learning (RL) algorithm presented in a previous work by Angiuli et al. This algorithm provides solutions to Mean Field Game (M...

Deep Reinforcement Learning for Infinite Horizon Mean Field Problems in Continuous Spaces

We present the development and analysis of a reinforcement learning (RL) algorithm designed to solve continuous-space mean field game (MFG) and mean field control (MFC) problems in a unified manner....

Collective Arbitrage and the Value of Cooperation

We introduce the notions of Collective Arbitrage and of Collective Super-replication in a discrete-time setting where agents are investing in their markets and are allowed to cooperate through excha...

Multivariate Systemic Risk Measures and Computation by Deep Learning Algorithms

In this work we propose deep learning-based algorithms for the computation of systemic shortfall risk measures defined via multivariate utility functions. We discuss the key related theoretical aspe...

Reinforcement Learning for Intra-and-Inter-Bank Borrowing and Lending Mean Field Control Game

We propose a mean field control game model for the intra-and-inter-bank borrowing and lending problem. This framework allows to study the competitive game arising between groups of collaborative ban...

Deep Learning for Systemic Risk Measures

The aim of this paper is to study a new methodological framework for systemic risk measures by applying deep learning method as a tool to compute the optimal strategy of capital allocations. Under t...

Reinforcement Learning Algorithm for Mixed Mean Field Control Games

We present a new combined \textit{mean field control game} (MFCG) problem which can be interpreted as a competitive game between collaborating groups and its solution as a Nash equilibrium between g...

Systemic Risk Models for Disjoint and Overlapping Groups with Equilibrium Strategies

We analyze the systemic risk for disjoint and overlapping groups (e.g., central clearing counterparties (CCP)) by proposing new models with realistic game features. Specifically, we generalize the s...

Optimal Trading with Signals and Stochastic Price Impact

Trading frictions are stochastic. They are, moreover, in many instances fast-mean reverting. Here, we study how to optimally trade in a market with stochastic price impact and study approximations t...

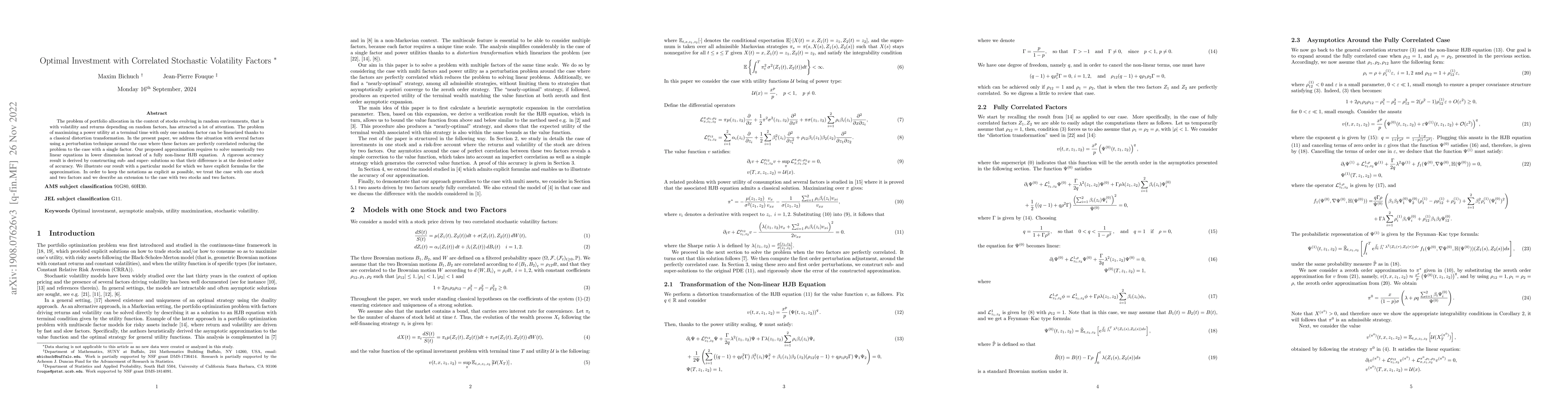

Optimal Investment with Correlated Stochastic Volatility Factors

The problem of portfolio allocation in the context of stocks evolving in random environments, that is with volatility and returns depending on random factors, has attracted a lot of attention. The p...

Catalan Numbers, Riccati Equations and Convergence

We analyze both finite and infinite systems of Riccati equations derived from stochastic differential games on infinite networks. We discuss a connection to the Catalan numbers and the convergence of ...

Feynman Formula for Discrete-time Quantum Walks

We explicitly connect (discrete-time) quantum walks on Z with a four-state Markov additive process via a Feynman-type formula (2.5). Using this representation, we derive a relation between the spectra...