Authors

Summary

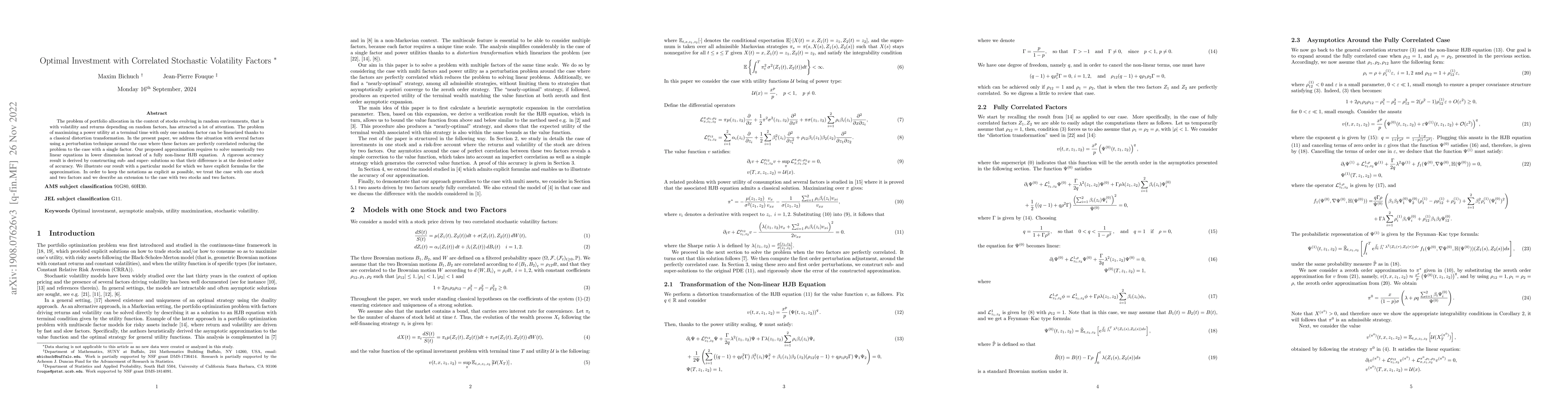

The problem of portfolio allocation in the context of stocks evolving in random environments, that is with volatility and returns depending on random factors, has attracted a lot of attention. The problem of maximizing a power utility at a terminal time with only one random factor can be linearized thanks to a classical distortion transformation. In the present paper, we address the situation with several factors using a perturbation technique around the case where these factors are perfectly correlated reducing the problem to the case with a single factor. Our proposed approximation requires to solve numerically two linear equations in lower dimension instead of a fully non-linear HJB equation. A rigorous accuracy result is derived by constructing sub- and super- solutions so that their difference is at the desired order of accuracy. We illustrate our result with a particular model for which we have explicit formulas for the approximation. In order to keep the notations as explicit as possible, we treat the case with one stock and two factors and we describe an extension to the case with two stocks and two factors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)