Summary

We consider an optimal investment and consumption problem for a Black-Scholes financial market with stochastic volatility and unknown stock appreciation rate. The volatility parameter is driven by an external economic factor modeled as a diffusion process of Ornstein-Uhlenbeck type with unknown drift. We use the dynamical programming approach and find an optimal financial strategy which depends on the drift parameter. To estimate the drift coefficient we observe the economic factor $Y$ in an interval $[0,T_0]$ for fixed $T_0>0$, and use sequential estimation. We show, that the consumption and investment strategy calculated through this sequential procedure is $\delta$-optimal.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

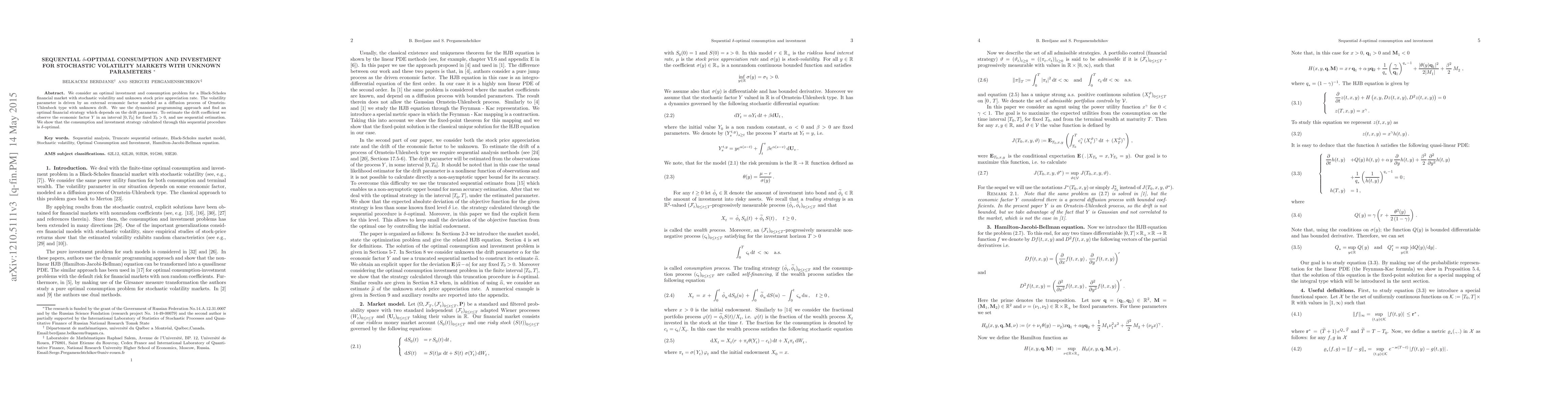

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal investment and consumption with forward preferences and uncertain parameters

Gechun Liang, Wing Fung Chong

| Title | Authors | Year | Actions |

|---|

Comments (0)