Sebastian Jaimungal

31 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Learning conditional distributions on continuous spaces

We investigate sample-based learning of conditional distributions on multi-dimensional unit boxes, allowing for different dimensions of the feature and target spaces. Our approach involves clusterin...

The Price of Information

When an investor is faced with the option to purchase additional information regarding an asset price, how much should she pay? To address this question, we solve for the indifference price of infor...

Nash Equilibria in Greenhouse Gas Offset Credit Markets

One approach to reducing greenhouse gas (GHG) emissions is to incentivize carbon capturing and carbon reducing projects while simultaneously penalising excess GHG output. In this work, we present a ...

Optimal Robust Reinsurance with Multiple Insurers

We study a reinsurer who faces multiple sources of model uncertainty. The reinsurer offers contracts to $n$ insurers whose claims follow compound Poisson processes representing both idiosyncratic an...

Eliciting Risk Aversion with Inverse Reinforcement Learning via Interactive Questioning

This paper proposes a novel framework for identifying an agent's risk aversion using interactive questioning. Our study is conducted in two scenarios: a one-period case and an infinite horizon case....

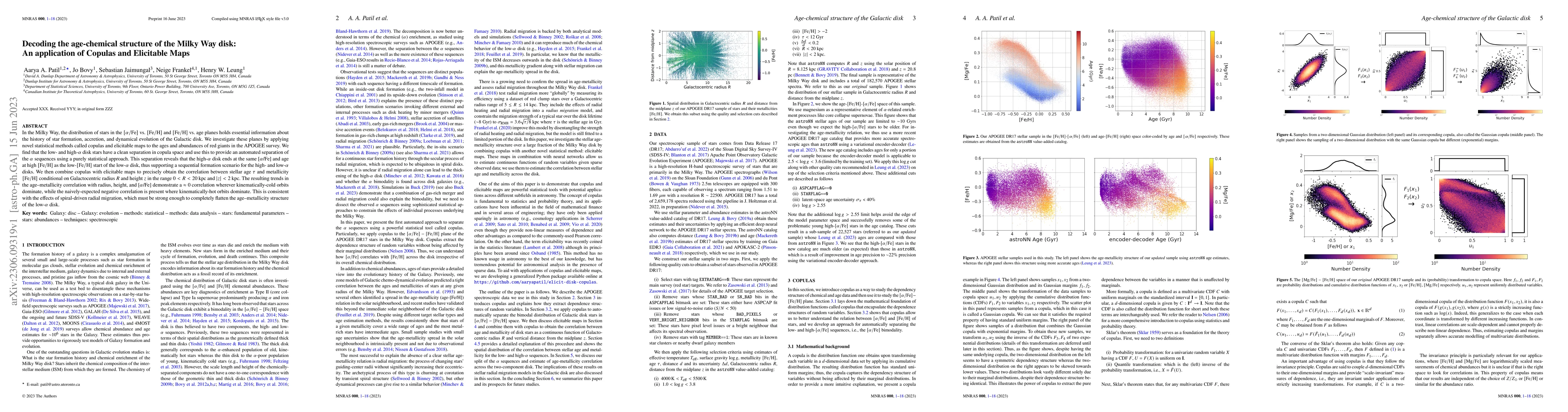

Decoding the age-chemical structure of the Milky Way disk: An application of Copulas and Elicitable Maps

In the Milky Way, the distribution of stars in the $[\alpha/\mathrm{Fe}]$ vs. $[\mathrm{Fe/H}]$ and $[\mathrm{Fe/H}]$ vs. age planes holds essential information about the history of star formation, ...

Risk Budgeting Allocation for Dynamic Risk Measures

We define and develop an approach for risk budgeting allocation -- a risk diversification portfolio strategy -- where risk is measured using a dynamic time-consistent risk measure. For this, we intr...

Optimal Trading in Automatic Market Makers with Deep Learning

This article explores the optimisation of trading strategies in Constant Function Market Makers (CFMMs) and centralised exchanges. We develop a model that accounts for the interaction between these ...

Robust Risk-Aware Option Hedging

The objectives of option hedging/trading extend beyond mere protection against downside risks, with a desire to seek gains also driving agent's strategies. In this study, we showcase the potential o...

FuNVol: A Multi-Asset Implied Volatility Market Simulator using Functional Principal Components and Neural SDEs

We introduce a new approach for generating sequences of implied volatility (IV) surfaces across multiple assets that is faithful to historical prices. We do so using a combination of functional data...

Distributional Method for Risk Averse Reinforcement Learning

We introduce a distributional method for learning the optimal policy in risk averse Markov decision process with finite state action spaces, latent costs, and stationary dynamics. We assume sequenti...

Exploratory Control with Tsallis Entropy for Latent Factor Models

We study optimal control in models with latent factors where the agent controls the distribution over actions, rather than actions themselves, in both discrete and continuous time. To encourage expl...

Stressing Dynamic Loss Models

Stress testing, and in particular, reverse stress testing, is a prominent exercise in risk management practice. Reverse stress testing, in contrast to (forward) stress testing, aims to find an alter...

Conditionally Elicitable Dynamic Risk Measures for Deep Reinforcement Learning

We propose a novel framework to solve risk-sensitive reinforcement learning (RL) problems where the agent optimises time-consistent dynamic spectral risk measures. Based on the notion of conditional...

Risk-Averse Markov Decision Processes through a Distributional Lens

By adopting a distributional viewpoint on law-invariant convex risk measures, we construct dynamics risk measures (DRMs) at the distributional level. We then apply these DRMs to investigate Markov d...

Reinforcement Learning with Dynamic Convex Risk Measures

We develop an approach for solving time-consistent risk-sensitive stochastic optimization problems using model-free reinforcement learning (RL). Specifically, we assume agents assess the risk of a s...

Principal agent mean field games in REC markets

Principal agent games are a growing area of research which focuses on the optimal behaviour of a principal and an agent, with the former contracting work from the latter, in return for providing a m...

Functional Data Analysis for Extracting the Intrinsic Dimensionality of Spectra: Application to Chemical Homogeneity in the Open Cluster M67

High-resolution spectroscopic surveys of the Milky Way have entered the Big Data regime and have opened avenues for solving outstanding questions in Galactic archaeology. However, exploiting their f...

Robust Risk-Aware Reinforcement Learning

We present a reinforcement learning (RL) approach for robust optimisation of risk-aware performance criteria. To allow agents to express a wide variety of risk-reward profiles, we assess the value o...

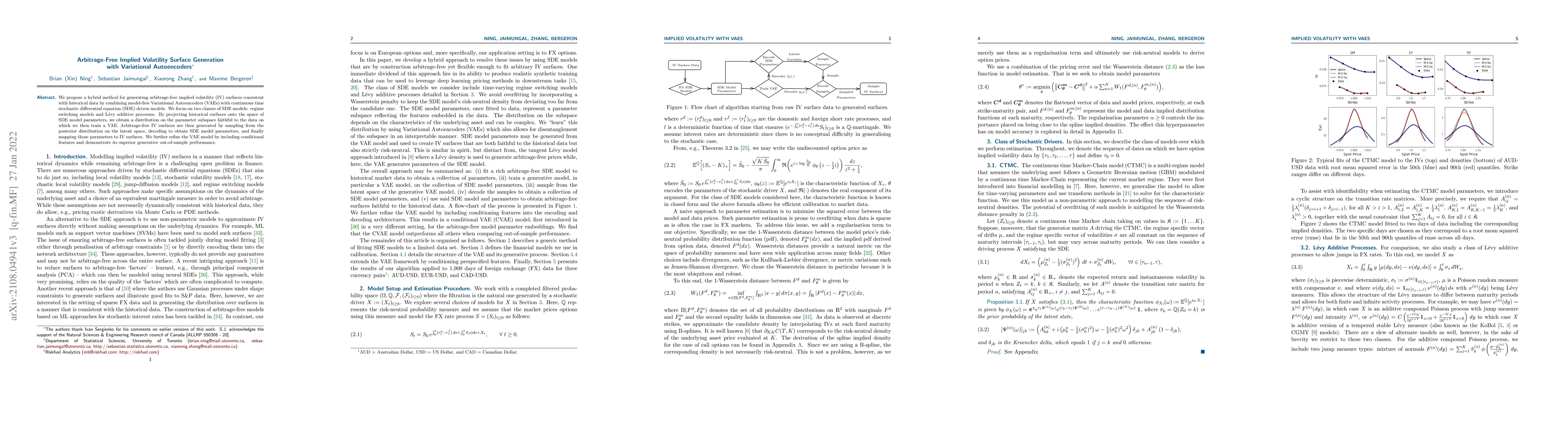

Arbitrage-Free Implied Volatility Surface Generation with Variational Autoencoders

We propose a hybrid method for generating arbitrage-free implied volatility (IV) surfaces consistent with historical data by combining model-free Variational Autoencoders (VAEs) with continuous time...

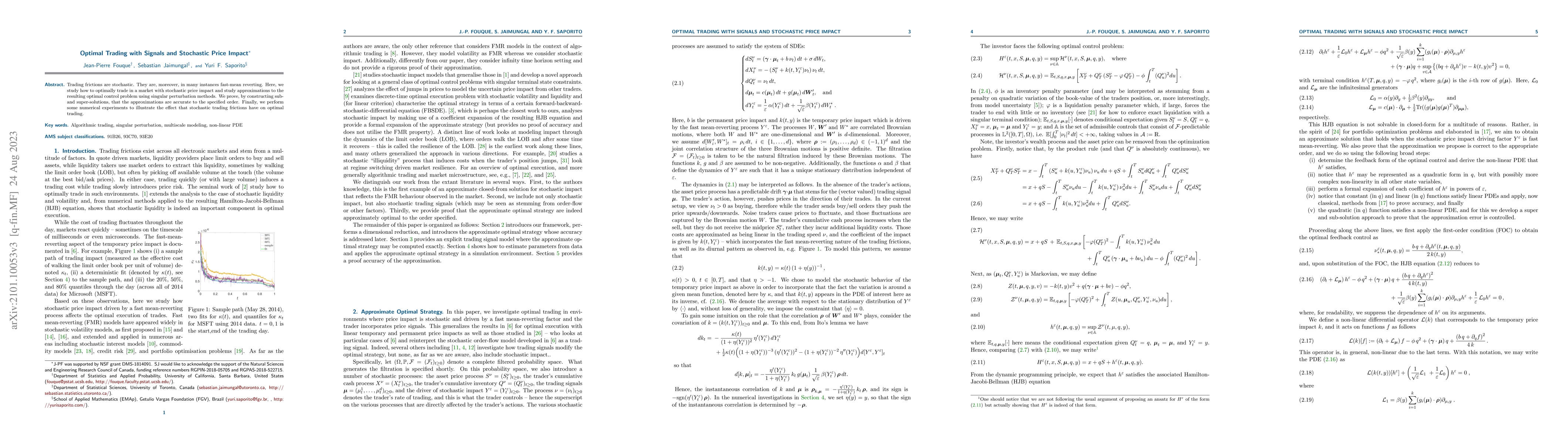

Optimal Trading with Signals and Stochastic Price Impact

Trading frictions are stochastic. They are, moreover, in many instances fast-mean reverting. Here, we study how to optimally trade in a market with stochastic price impact and study approximations t...

Portfolio Optimisation within a Wasserstein Ball

We study the problem of active portfolio management where an investor aims to outperform a benchmark strategy's risk profile while not deviating too far from it. Specifically, an investor considers ...

Exploratory LQG Mean Field Games with Entropy Regularization

We study a general class of entropy-regularized multi-variate LQG mean field games (MFGs) in continuous time with $K$ distinct sub-population of agents. We extend the notion of actions to action dis...

Deep Q-Learning for Nash Equilibria: Nash-DQN

Model-free learning for multi-agent stochastic games is an active area of research. Existing reinforcement learning algorithms, however, are often restricted to zero-sum games, and are applicable on...

Kullback-Leibler Barycentre of Stochastic Processes

We consider the problem where an agent aims to combine the views and insights of different experts' models. Specifically, each expert proposes a diffusion process over a finite time horizon. The agent...

Robust Reinforcement Learning with Dynamic Distortion Risk Measures

In a reinforcement learning (RL) setting, the agent's optimal strategy heavily depends on her risk preferences and the underlying model dynamics of the training environment. These two aspects influenc...

Nash Equilibrium between Brokers and Traders

We study the perfect information Nash equilibrium between a broker and her clients -- an informed trader and an uniformed trader. In our model, the broker trades in the lit exchange where trades have ...

Broker-Trader Partial Information Nash Equilibria

We study partial information Nash equilibrium between a broker and an informed trader. In this model, the informed trader, who possesses knowledge of a trading signal, trades multiple assets with the ...

Multi-Agent Reinforcement Learning for Greenhouse Gas Offset Credit Markets

Climate change is a major threat to the future of humanity, and its impacts are being intensified by excess man-made greenhouse gas emissions. One method governments can employ to control these emissi...

Model Ambiguity in Risk Sharing with Monotone Mean-Variance

We consider the problem of an agent who faces losses over a finite time horizon and may choose to share some of these losses with a counterparty. The agent is uncertain about the true loss distributio...

Deviations from Tradition: Stylized Facts in the Era of DeFi

Decentralized Exchanges (DEXs) are now a significant component of the financial world where billions of dollars are traded daily. Differently from traditional markets, which are typically based on Lim...