Summary

We study the perfect information Nash equilibrium between a broker and her clients -- an informed trader and an uniformed trader. In our model, the broker trades in the lit exchange where trades have instantaneous and transient price impact with exponential resilience, while both clients trade with the broker. The informed trader and the broker maximise expected wealth subject to inventory penalties, while the uninformed trader is not strategic and sends the broker random buy and sell orders. We characterise the Nash equilibrium of the trading strategies with the solution to a coupled system of forward-backward stochastic differential equations (FBSDEs). We solve this system explicitly and study the effect of information, profitability, and inventory control in the trading strategies of the broker and the informed trader.

AI Key Findings

Generated Sep 02, 2025

Methodology

The research employs a model of perfect information Nash equilibrium between a broker and two types of traders: an informed trader and an uninformed trader. The model considers instantaneous and transient price impact with exponential resilience, with both clients trading with the broker. The informed trader and broker aim to maximize expected wealth subject to inventory penalties, while the uninformed trader sends random buy and sell orders.

Key Results

- The trading strategies of the broker and informed trader are characterized by solving a coupled system of forward-backward stochastic differential equations (FBSDEs).

- Explicit solutions to the FBSDEs are obtained, allowing for the analysis of the effects of information, profitability, and inventory control on trading strategies.

- The Nash equilibrium is shown to exist and is unique under specific conditions on model parameters.

- The impact of transient price impact parameters (p and h) on the equilibrium is studied, revealing that as these parameters increase, stricter bounds on the time horizon (T) are required for existence and uniqueness.

- Comparison with a two-stage optimization model from Cartea and Sánchez-Betancourt (2022) indicates that the informed trader's mark-to-market increases by approximately 37 basis points when adopting the Nash equilibrium strategy, while the broker's decreases by 91 basis points.

Significance

This research is significant as it contributes to understanding optimal trading strategies in markets with asymmetric information, which has implications for financial market microstructure and algorithmic trading.

Technical Contribution

The paper presents a closed-form solution to a coupled system of FBSDEs characterizing the Nash equilibrium in a broker-trader model with transient price impact.

Novelty

The work distinguishes itself by explicitly solving the FBSDEs governing the equilibrium strategies, providing insights into the interplay between information asymmetry, price impact, and inventory control in financial markets.

Limitations

- The study assumes perfect information for the informed trader, which may not reflect real-world scenarios where information is imperfect or noisy.

- The model does not account for transaction costs or other frictions typically present in financial markets.

Future Work

- Investigate the impact of imperfect information and noisy signals on the Nash equilibrium.

- Extend the model to include transaction costs and other market frictions to enhance its realism and applicability.

Paper Details

PDF Preview

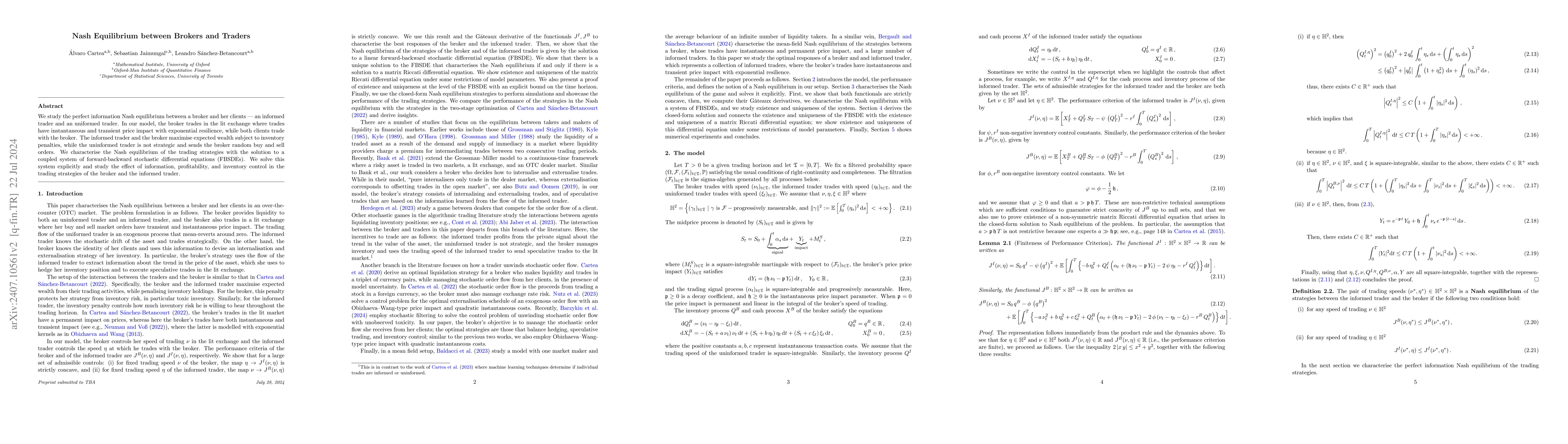

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLiquidity Competition Between Brokers and an Informed Trader

Zi Li, Ryan Donnelly

A Mean Field Game between Informed Traders and a Broker

Philippe Bergault, Leandro Sánchez-Betancourt

| Title | Authors | Year | Actions |

|---|

Comments (0)