Authors

Summary

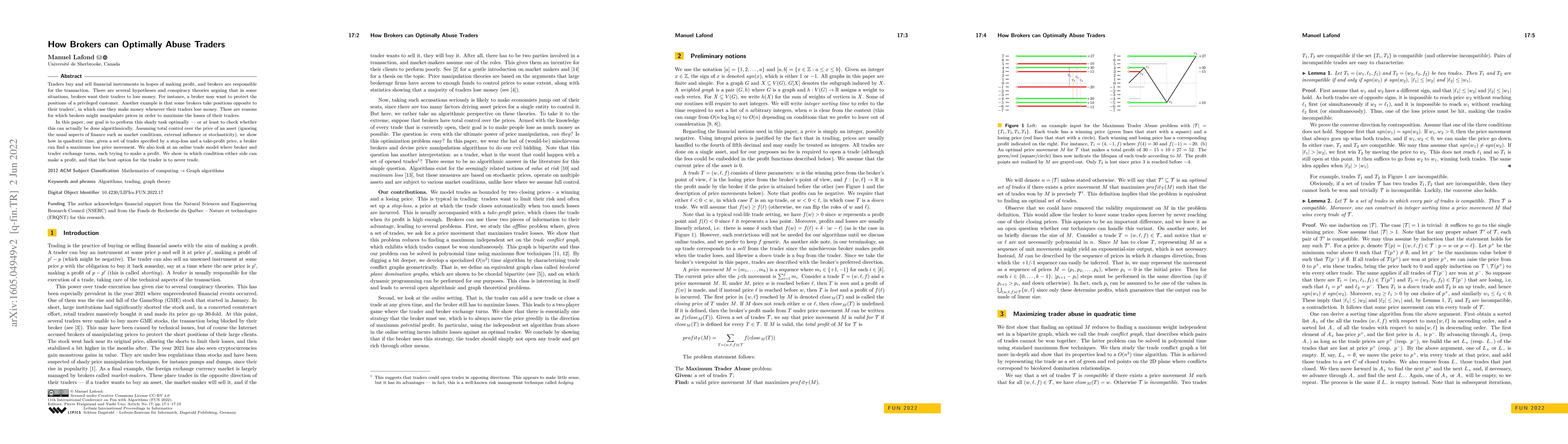

Traders buy and sell financial instruments in hopes of making profit, and brokers are responsible for the transaction. There are several hypotheses and conspiracy theories arguing that in some situations, brokers want their traders to lose money. For instance, a broker may want to protect the positions of a privileged customer. Another example is that some brokers take positions opposite to their traders', in which case they make money whenever their traders lose money. These are reasons for which brokers might manipulate prices in order to maximize the losses of their traders. In this paper, our goal is to perform this shady task optimally -- or at least to check whether this can actually be done algorithmically. Assuming total control over the price of an asset (ignoring the usual aspects of finance such as market conditions, external influence or stochasticity), we show how in quadratic time, given a set of trades specified by a stop-loss and a take-profit price, a broker can find a maximum loss price movement. We also look at an online trade model where broker and trader exchange turns, each trying to make a profit. We show in which condition either side can make a profit, and that the best option for the trader is to never trade.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNash Equilibrium between Brokers and Traders

Sebastian Jaimungal, Álvaro Cartea, Leandro Sánchez-Betancourt

Liquidity Competition Between Brokers and an Informed Trader

Zi Li, Ryan Donnelly

A Mean Field Game between Informed Traders and a Broker

Philippe Bergault, Leandro Sánchez-Betancourt

No citations found for this paper.

Comments (0)