Summary

We consider the problem of an agent who faces losses over a finite time horizon and may choose to share some of these losses with a counterparty. The agent is uncertain about the true loss distribution and has multiple models for the losses. Their goal is to optimize a mean-variance type criterion with model ambiguity through risk sharing. We construct such a criterion by adapting the monotone mean-variance preferences of Maccheroni et al. (2009) to the multiple models setting and exploit a dual representation to mitigate time-consistency issues. Assuming a Cram\'er-Lundberg loss model, we fully characterize the optimal risk sharing contract and the agent's wealth process under the optimal strategy. Furthermore, we prove that the strategy we obtain is admissible and prove that the value function satisfies the appropriate verification conditions. Finally, we apply the optimal strategy to an insurance setting using data from a Spanish automobile insurance portfolio, where we obtain differing models using cross-validation and provide numerical illustrations of the results.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research employs a Cramér-Lundberg loss model to analyze risk sharing with model ambiguity. It adapts monotone mean-variance preferences to a multiple models setting, using a dual representation to address time-consistency issues.

Key Results

- Optimal risk sharing contract and agent's wealth process under the optimal strategy are fully characterized.

- The obtained strategy is proven to be admissible.

- Verification conditions for the value function are satisfied.

Significance

This research is important for understanding how an agent can optimize a mean-variance type criterion with model ambiguity in risk sharing, with potential applications in insurance settings.

Technical Contribution

The paper presents a dual representation approach to mitigate time-consistency issues in model ambiguity settings and fully characterizes the optimal risk sharing contract under monotone mean-variance preferences.

Novelty

This work extends existing mean-variance models to incorporate model ambiguity and provides a dual representation solution, offering new insights into risk sharing optimization.

Limitations

- The study assumes a finite time horizon for loss occurrences.

- Results are based on a specific loss model (Cramér-Lundberg) and may not generalize to all loss distributions.

Future Work

- Explore risk sharing strategies under different loss models and time horizons.

- Investigate the applicability of the proposed method in other financial contexts beyond insurance.

Paper Details

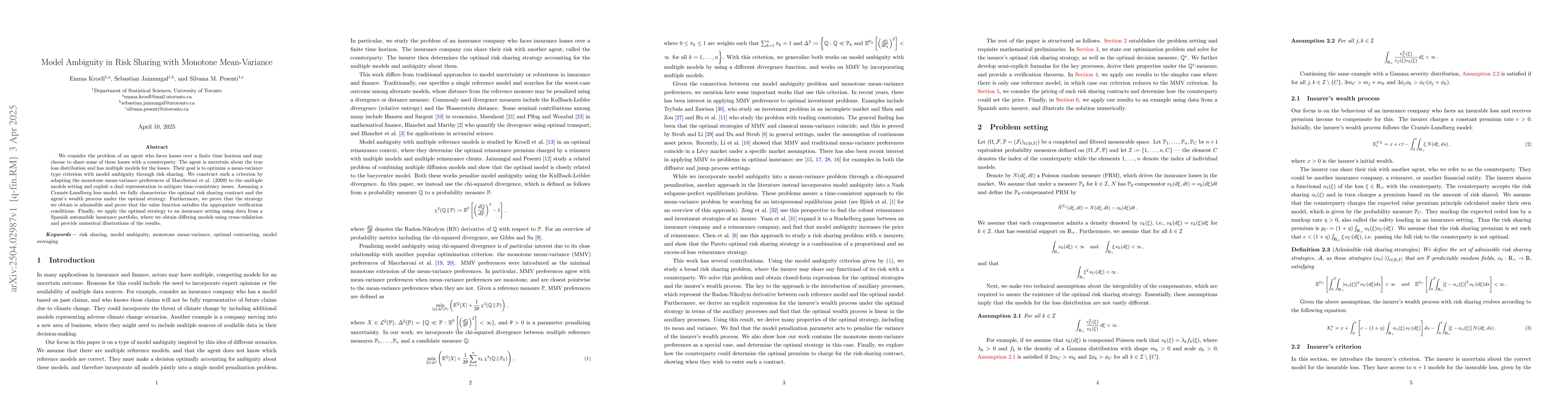

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNewsvendor under Mean-Variance Ambiguity and Misspecification

Feng Liu, Zhi Chen, Ruodu Wang et al.

Continuous-Time Monotone Mean-Variance Portfolio Selection in Jump-Diffusion Model

Yuchen Li, Zongxia Liang, Shunzhi Pang

Constrained monotone mean-variance problem with random coefficients

Ying Hu, Xiaomin Shi, Zuo Quan Xu

No citations found for this paper.

Comments (0)