Summary

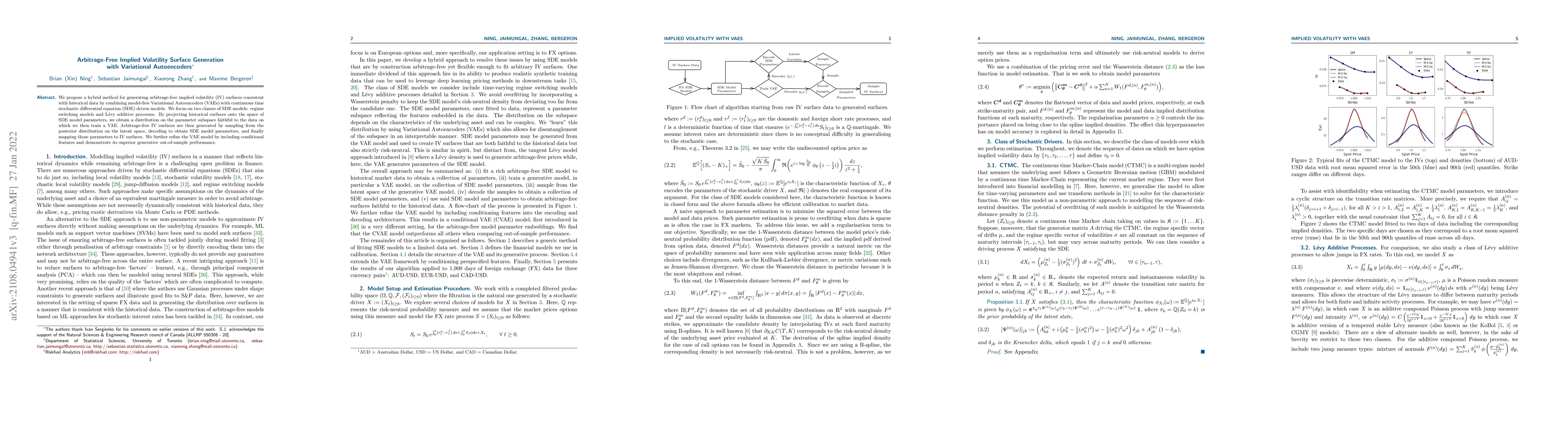

We propose a hybrid method for generating arbitrage-free implied volatility (IV) surfaces consistent with historical data by combining model-free Variational Autoencoders (VAEs) with continuous time stochastic differential equation (SDE) driven models. We focus on two classes of SDE models: regime switching models and L\'evy additive processes. By projecting historical surfaces onto the space of SDE model parameters, we obtain a distribution on the parameter subspace faithful to the data on which we then train a VAE. Arbitrage-free IV surfaces are then generated by sampling from the posterior distribution on the latent space, decoding to obtain SDE model parameters, and finally mapping those parameters to IV surfaces. We further refine the VAE model by including conditional features and demonstrate its superior generative out-of-sample performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Two-Step Framework for Arbitrage-Free Prediction of the Implied Volatility Surface

Gongqiu Zhang, Wenyong Zhang, Lingfei Li

Building arbitrage-free implied volatility: Sinkhorn's algorithm and variants

Hadrien De March, Pierre Henry-Labordere

| Title | Authors | Year | Actions |

|---|

Comments (0)