Summary

We present a reinforcement learning (RL) approach for robust optimisation of risk-aware performance criteria. To allow agents to express a wide variety of risk-reward profiles, we assess the value of a policy using rank dependent expected utility (RDEU). RDEU allows the agent to seek gains, while simultaneously protecting themselves against downside risk. To robustify optimal policies against model uncertainty, we assess a policy not by its distribution, but rather, by the worst possible distribution that lies within a Wasserstein ball around it. Thus, our problem formulation may be viewed as an actor/agent choosing a policy (the outer problem), and the adversary then acting to worsen the performance of that strategy (the inner problem). We develop explicit policy gradient formulae for the inner and outer problems, and show its efficacy on three prototypical financial problems: robust portfolio allocation, optimising a benchmark, and statistical arbitrage.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

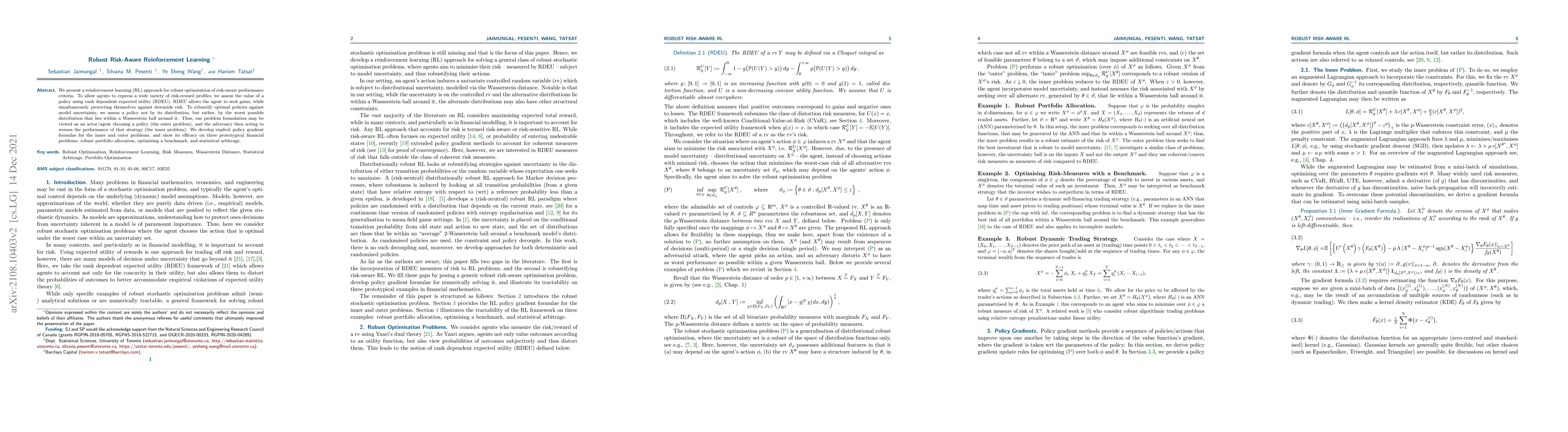

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust Reinforcement Learning with Dynamic Distortion Risk Measures

Sebastian Jaimungal, Anthony Coache

| Title | Authors | Year | Actions |

|---|

Comments (0)