Summary

We propose a novel framework to solve risk-sensitive reinforcement learning (RL) problems where the agent optimises time-consistent dynamic spectral risk measures. Based on the notion of conditional elicitability, our methodology constructs (strictly consistent) scoring functions that are used as penalizers in the estimation procedure. Our contribution is threefold: we (i) devise an efficient approach to estimate a class of dynamic spectral risk measures with deep neural networks, (ii) prove that these dynamic spectral risk measures may be approximated to any arbitrary accuracy using deep neural networks, and (iii) develop a risk-sensitive actor-critic algorithm that uses full episodes and does not require any additional nested transitions. We compare our conceptually improved reinforcement learning algorithm with the nested simulation approach and illustrate its performance in two settings: statistical arbitrage and portfolio allocation on both simulated and real data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

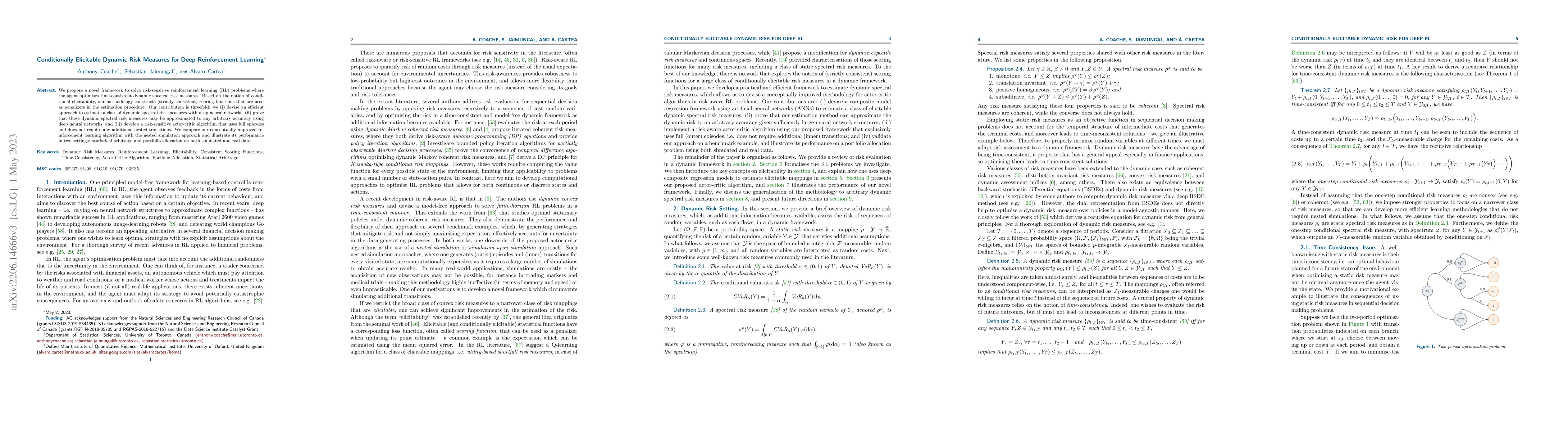

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConstructing elicitable risk measures

Silvana M. Pesenti, Marlon Moresco, Akif Ince et al.

Deep Reinforcement Learning for Equal Risk Pricing and Hedging under Dynamic Expectile Risk Measures

Reinforcement Learning with Dynamic Convex Risk Measures

Sebastian Jaimungal, Anthony Coache

Robust Reinforcement Learning with Dynamic Distortion Risk Measures

Sebastian Jaimungal, Anthony Coache

| Title | Authors | Year | Actions |

|---|

Comments (0)