Summary

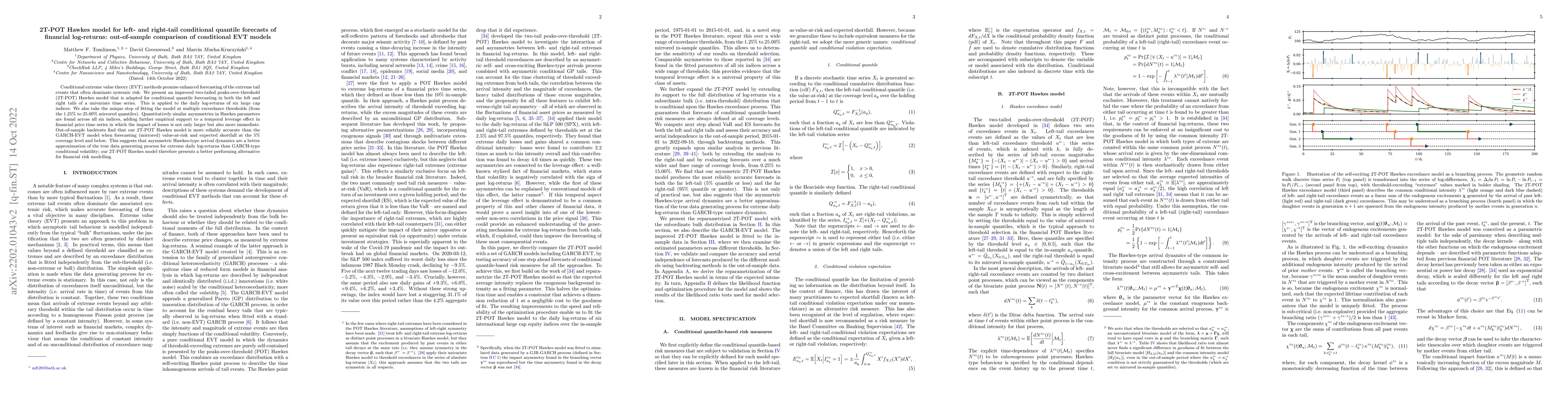

Conditional extreme value theory (EVT) methods promise enhanced forecasting of the extreme tail events that often dominate systemic risk. We present an improved two-tailed peaks-over-threshold (2T-POT) Hawkes model that is adapted for conditional quantile forecasting in both the left and right tails of a univariate time series. This is applied to the daily log-returns of six large cap indices. We also take the unique step of fitting the model at multiple exceedance thresholds (from the 1.25% to 25.00% mirrored quantiles). Quantitatively similar asymmetries in Hawkes parameters are found across all six indices, adding further empirical support to a temporal leverage effect in financial price time series in which the impact of losses is not only larger but also more immediate. Out-of-sample backtests find that our 2T-POT Hawkes model is more reliably accurate than the GARCH-EVT model when forecasting (mirrored) value-at-risk and expected shortfall at the 5% coverage level and below. This suggests that asymmetric Hawkes-type arrival dynamics are a better approximation of the true data generating process for extreme daily log-returns than GARCH-type conditional volatility; our 2T-POT Hawkes model therefore presents a better performing alternative for financial risk modelling.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)