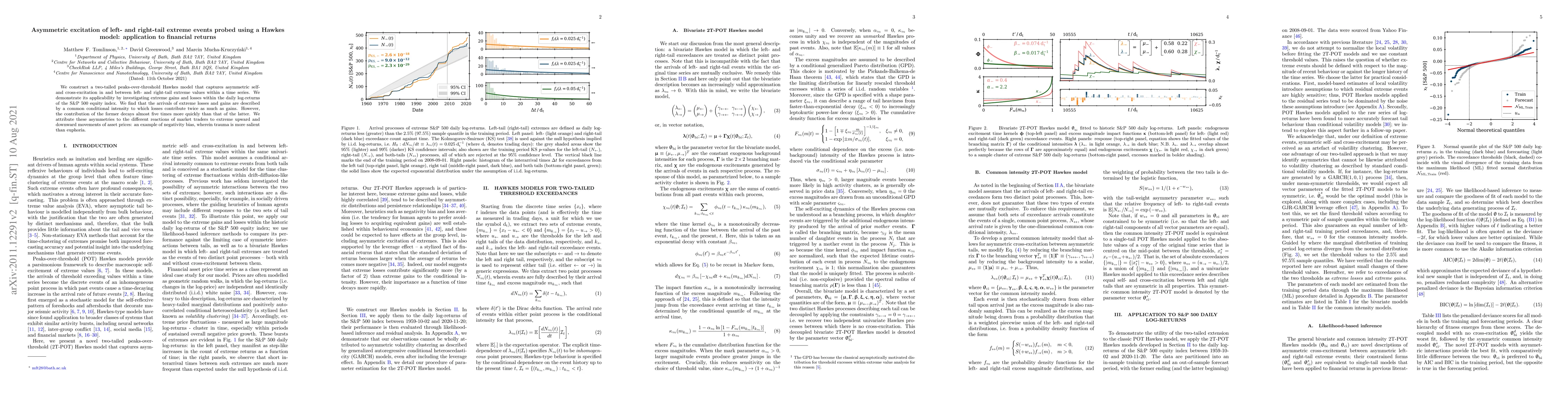

Summary

We construct a two-tailed peak-over-threshold Hawkes model that captures asymmetric self- and cross-excitation in and between left- and right-tail extreme values within a time series. We demonstrate its applicability by investigating extreme gains and losses within the daily log-returns of the S&P 500 equity index. We find that the arrivals of extreme losses and gains are described by a common conditional intensity to which losses contribute twice as much as gains. However, the contribution of the former decays almost five times more quickly than that of the latter. We attribute these asymmetries to the different reactions of market traders to extreme upward and downward movements of asset prices: an example of negativity bias, wherein trauma is more salient than euphoria.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers2T-POT Hawkes model for left- and right-tail conditional quantile forecasts of financial log-returns: out-of-sample comparison of conditional EVT models

Marcin Mucha-Kruczynski, Matthew F. Tomlinson, David Greenwood

| Title | Authors | Year | Actions |

|---|

Comments (0)