Summary

We propose a novel algorithm which allows to sample paths from an underlying price process in a local volatility model and to achieve a substantial variance reduction when pricing exotic options. The new algorithm relies on the construction of a discrete multinomial tree. The crucial feature of our approach is that -- in a similar spirit to the Brownian Bridge -- each random path runs backward from a terminal fixed point to the initial spot price. We characterize the tree in two alternative ways: in terms of the optimal grids originating from the Recursive Marginal Quantization algorithm and following an approach inspired by the finite difference approximation of the diffusion's infinitesimal generator. We assess the reliability of the new methodology comparing the performance of both approaches and benchmarking them with competitor Monte Carlo methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

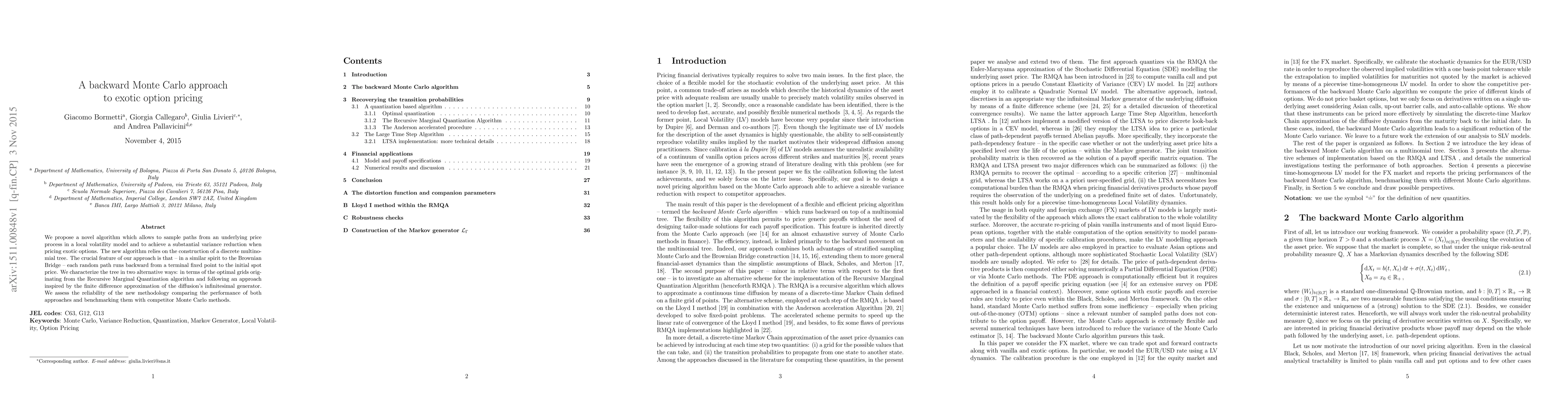

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)