Summary

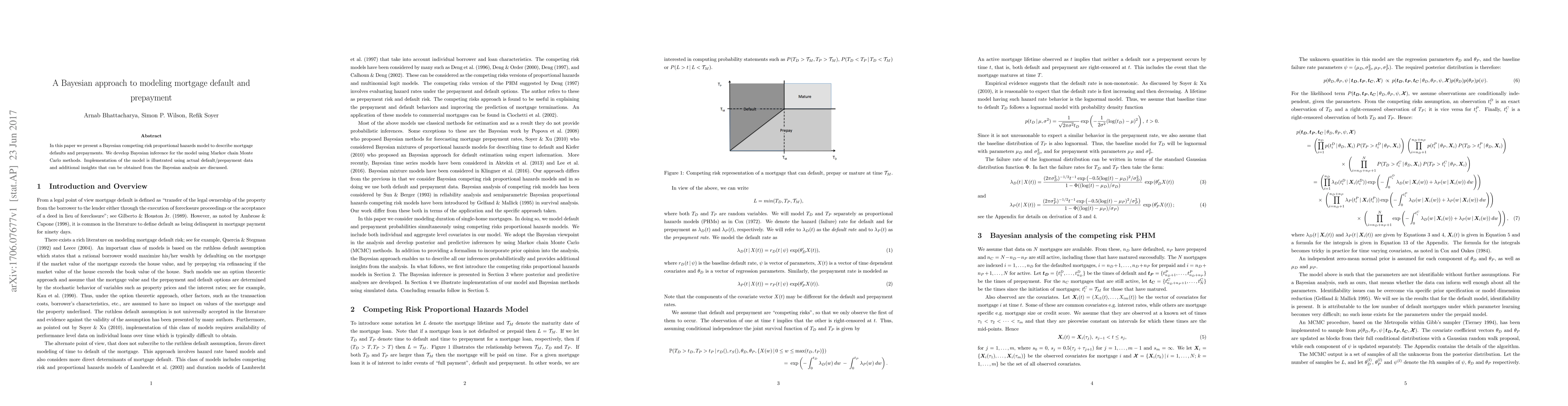

In this paper we present a Bayesian competing risk proportional hazards model to describe mortgage defaults and prepayments. We develop Bayesian inference for the model using Markov chain Monte Carlo methods. Implementation of the model is illustrated using actual default/prepayment data and additional insights that can be obtained from the Bayesian analysis are discussed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)