Summary

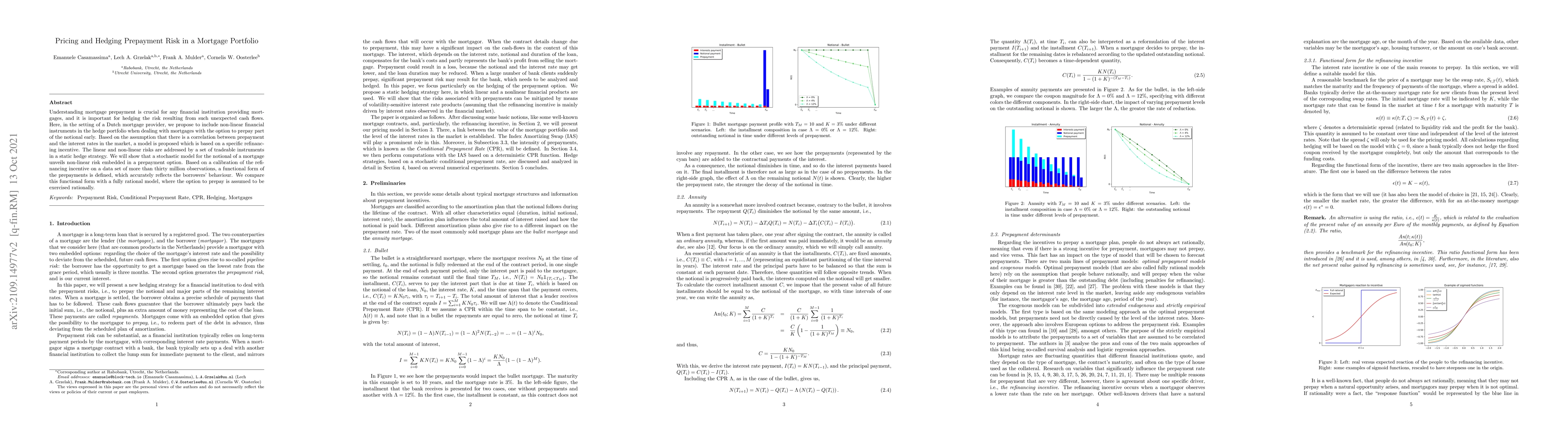

Understanding mortgage prepayment is crucial for any financial institution providing mortgages, and it is important for hedging the risk resulting from such unexpected cash flows. Here, in the setting of a Dutch mortgage provider, we propose to include non-linear financial instruments in the hedge portfolio when dealing with mortgages with the option to prepay part of the notional early. Based on the assumption that there is a correlation between prepayment and the interest rates in the market, a model is proposed which is based on a specific refinancing incentive. The linear and non-linear risks are addressed by a set of tradeable instruments in a static hedge strategy. We will show that a stochastic model for the notional of a mortgage unveils non-linear risk embedded in a prepayment option. Based on a calibration of the refinancing incentive on a data set of more than thirty million observations, a functional form of the prepayments is defined, which accurately reflects the borrowers' behaviour. We compare this functional form with a fully rational model, where the option to prepay is assumed to be exercised rationally.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)