Summary

Current understanding holds that financial contagion is driven mainly by the system-wide interconnectedness of institutions. A distinction has been made between systematic and idiosyncratic channels of contagion, with shocks transmitted through the latter expected to be substantially more likely to lead to systemic crisis than through the former. Idiosyncratic connectivity is thought to be driven not simply by obviously shared characteristics among institutions, but more by latent characteristics that lead to the holding of related securities. We develop a graphical model for multivariate financial time series with interest in uncovering the latent positions of nodes in a network intended to capture idiosyncratic relationships. We propose a hierarchical model consisting of a VAR, a covariance graphical model (CGM) and a latent position model (LPM). The VAR enables us to extract useful information on the idiosyncratic components, which are used by the CGM to model the network and the LPM uncovers the spatial position of the nodes. We also develop a Markov chain Monte Carlo algorithm that iterates between sampling parameters of the CGM and the LPM, using samples from the latter to update prior information for covariance graph selection. We show empirically that modeling the idiosyncratic channel of contagion using our approach can relate latent institutional features to systemic vulnerabilities prior to a crisis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

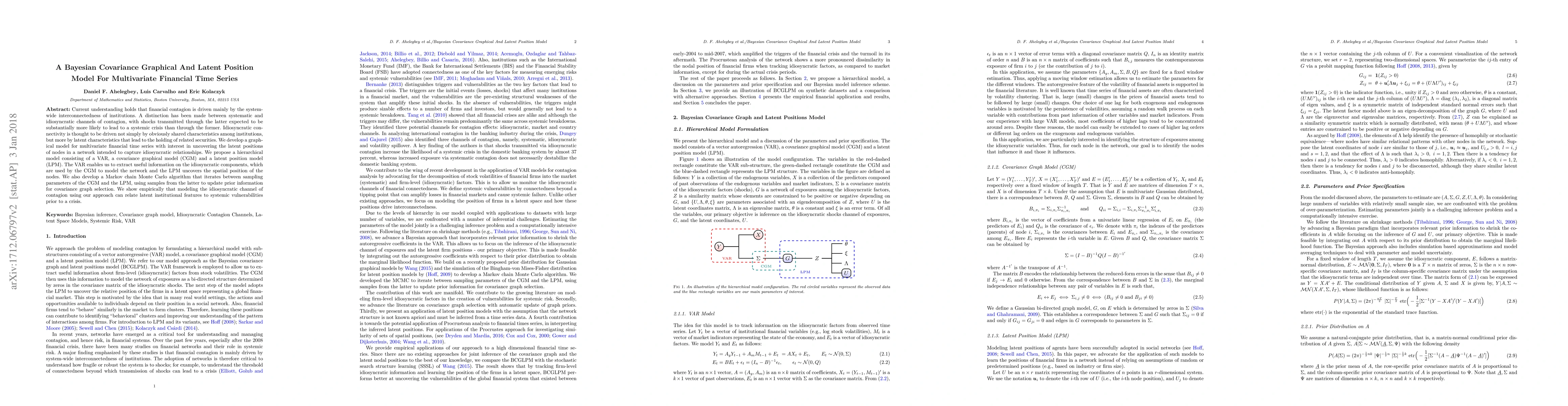

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA latent space model for multivariate count data time series analysis

Riccardo Rastelli, Hardeep Kaur

| Title | Authors | Year | Actions |

|---|

Comments (0)