Summary

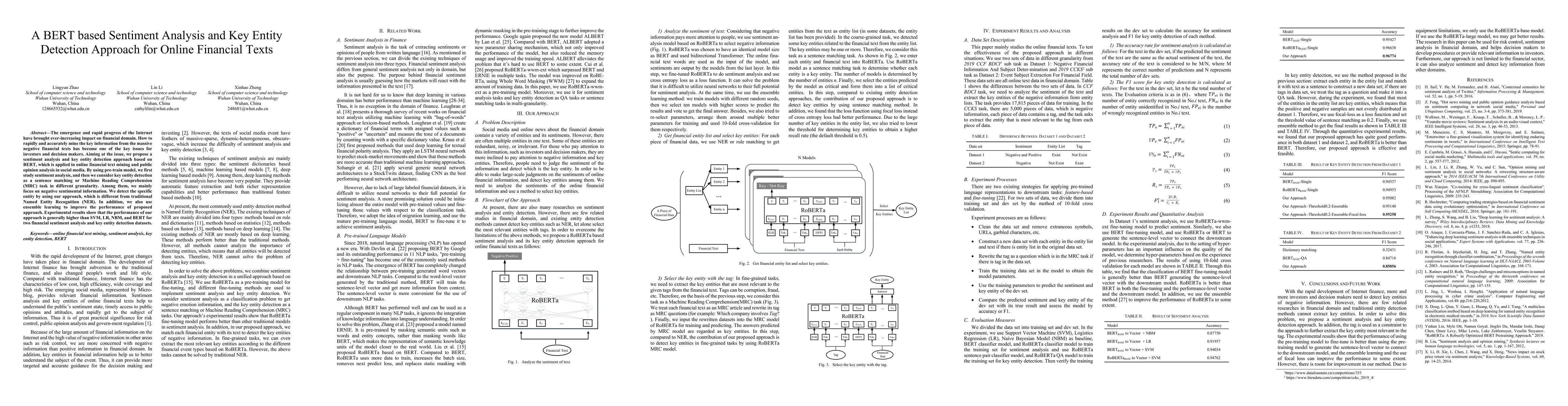

The emergence and rapid progress of the Internet have brought ever-increasing impact on financial domain. How to rapidly and accurately mine the key information from the massive negative financial texts has become one of the key issues for investors and decision makers. Aiming at the issue, we propose a sentiment analysis and key entity detection approach based on BERT, which is applied in online financial text mining and public opinion analysis in social media. By using pre-train model, we first study sentiment analysis, and then we consider key entity detection as a sentence matching or Machine Reading Comprehension (MRC) task in different granularity. Among them, we mainly focus on negative sentimental information. We detect the specific entity by using our approach, which is different from traditional Named Entity Recognition (NER). In addition, we also use ensemble learning to improve the performance of proposed approach. Experimental results show that the performance of our approach is generally higher than SVM, LR, NBM, and BERT for two financial sentiment analysis and key entity detection datasets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinEntity: Entity-level Sentiment Classification for Financial Texts

Yi Yang, Yixuan Tang, Allen H Huang et al.

SEntFiN 1.0: Entity-Aware Sentiment Analysis for Financial News

Ankur Sinha, Rishu Kumar, Pekka Malo et al.

A Multi-Level Sentiment Analysis Framework for Financial Texts

Xin Li, Yiwei Liu, Junbo Wang et al.

A sentiment analysis model for car review texts based on adversarial training and whole word mask BERT

Ang Li, Jian Liang, Yingxia Shao et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)