Authors

Summary

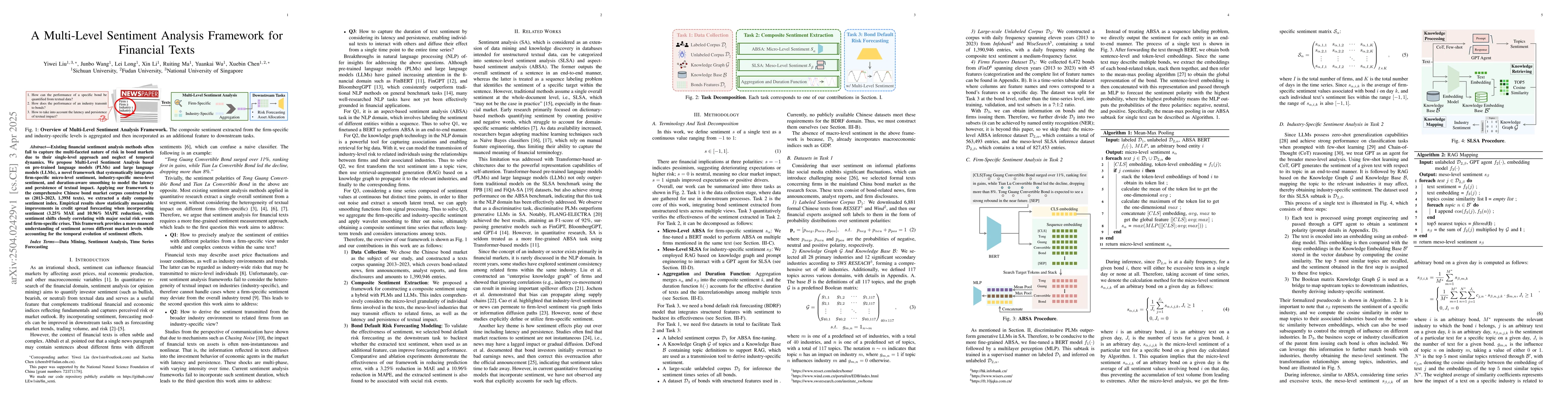

Existing financial sentiment analysis methods often fail to capture the multi-faceted nature of risk in bond markets due to their single-level approach and neglect of temporal dynamics. We propose Multi-Level Sentiment Analysis based on pre-trained language models (PLMs) and large language models (LLMs), a novel framework that systematically integrates firm-specific micro-level sentiment, industry-specific meso-level sentiment, and duration-aware smoothing to model the latency and persistence of textual impact. Applying our framework to the comprehensive Chinese bond market corpus constructed by us (2013-2023, 1.39M texts), we extracted a daily composite sentiment index. Empirical results show statistically measurable improvements in credit spread forecasting when incorporating sentiment (3.25% MAE and 10.96% MAPE reduction), with sentiment shifts closely correlating with major social risk events and firm-specific crises. This framework provides a more nuanced understanding of sentiment across different market levels while accounting for the temporal evolution of sentiment effects.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research proposes a Multi-Level Sentiment Analysis framework using pre-trained language models (PLMs) and large language models (LLMs) to capture firm-specific micro-level sentiment, industry-specific meso-level sentiment, and duration-aware smoothing for temporal dynamics in bond market texts.

Key Results

- The framework improved credit spread forecasting with a 3.25% MAE and 10.96% MAPE reduction by incorporating sentiment analysis.

- Sentiment shifts closely correlated with major social risk events and firm-specific crises.

- The daily composite sentiment index provided a nuanced understanding of sentiment across different market levels and temporal evolution.

Significance

This research is important as it offers a more comprehensive and dynamic approach to financial sentiment analysis, which can enhance risk assessment and forecasting in bond markets.

Technical Contribution

The development of a Multi-Level Sentiment Analysis framework that integrates micro, meso, and macro levels of sentiment with temporal awareness for financial texts.

Novelty

This work stands out by addressing the shortcomings of existing single-level sentiment analysis methods in financial texts, incorporating temporal dynamics, and providing a more granular understanding of sentiment across firm and industry levels.

Limitations

- The study is limited to the Chinese bond market corpus (2013-2023) and may not generalize directly to other markets without adaptation.

- Reliance on pre-trained and large language models may introduce biases or inaccuracies specific to the training data.

Future Work

- Exploring the applicability of this framework to other financial markets and languages.

- Investigating methods to mitigate potential biases introduced by PLMs and LLMs.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinEntity: Entity-level Sentiment Classification for Financial Texts

Yi Yang, Yixuan Tang, Allen H Huang et al.

EFSA: Towards Event-Level Financial Sentiment Analysis

Qing He, Tianyu Chen, Yiming Zhang et al.

A Pluggable Multi-Task Learning Framework for Sentiment-Aware Financial Relation Extraction

Hailin Wang, Jinming Luo

No citations found for this paper.

Comments (0)