Summary

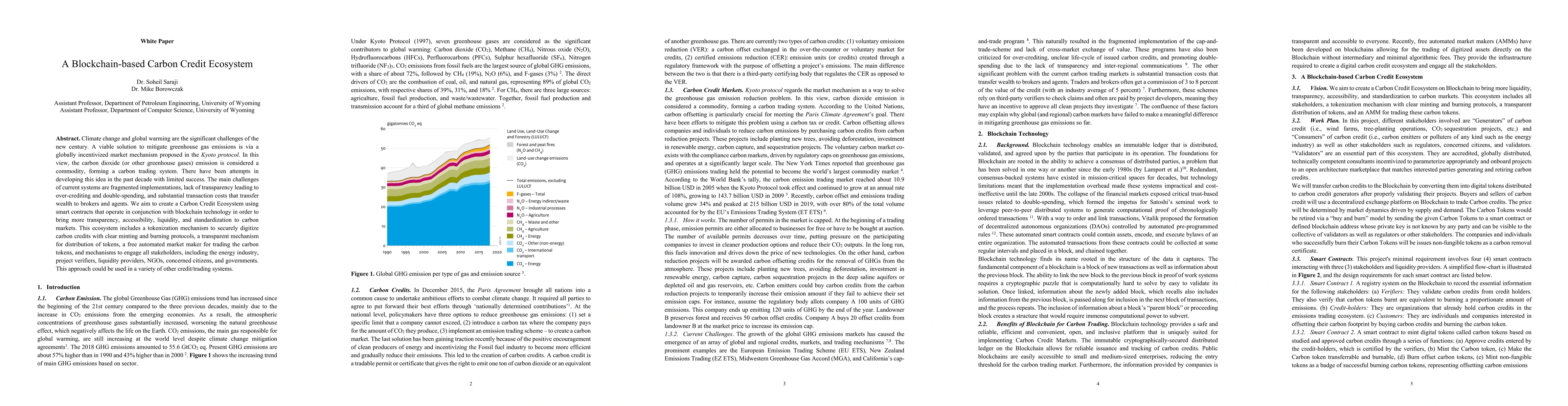

Climate change and global warming are the significant challenges of the new century. A viable solution to mitigate greenhouse gas emissions is via a globally incentivized market mechanism proposed in the Kyoto protocol. In this view, the carbon dioxide (or other greenhouse gases) emission is considered a commodity, forming a carbon trading system. There have been attempts in developing this idea in the past decade with limited success. The main challenges of current systems are fragmented implementations, lack of transparency leading to over-crediting and double-spending, and substantial transaction costs that transfer wealth to brokers and agents. We aim to create a Carbon Credit Ecosystem using smart contracts that operate in conjunction with blockchain technology in order to bring more transparency, accessibility, liquidity, and standardization to carbon markets. This ecosystem includes a tokenization mechanism to securely digitize carbon credits with clear minting and burning protocols, a transparent mechanism for distribution of tokens, a free automated market maker for trading the carbon tokens, and mechanisms to engage all stakeholders, including the energy industry, project verifiers, liquidity providers, NGOs, concerned citizens, and governments. This approach could be used in a variety of other credit/trading systems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)