Authors

Summary

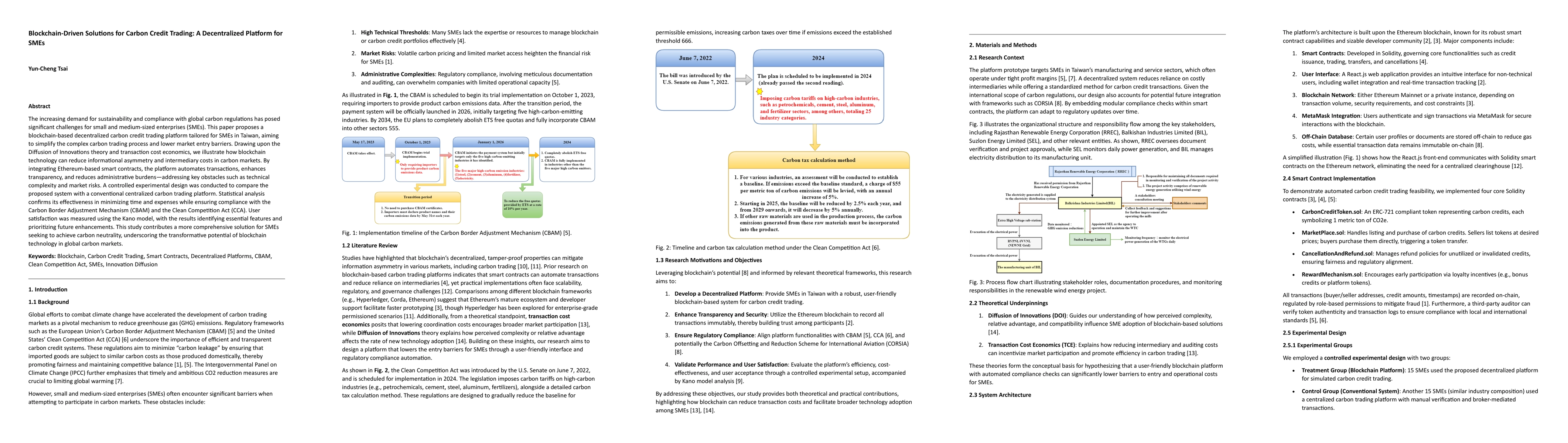

The increasing demand for sustainability and compliance with global carbon regulations has posed significant challenges for small and medium-sized enterprises (SMEs). This paper proposes a blockchain-based decentralized carbon credit trading platform tailored for SMEs in Taiwan, aiming to simplify the complex carbon trading process and lower market entry barriers. Drawing upon the Diffusion of Innovations theory and transaction cost economics, we illustrate how blockchain technology can reduce informational asymmetry and intermediary costs in carbon markets. By integrating Ethereum-based smart contracts, the platform automates transactions, enhances transparency, and reduces administrative burdens - addressing key obstacles such as technical complexity and market risks. A controlled experimental design was conducted to compare the proposed system with a conventional centralized carbon trading platform. Statistical analysis confirms its effectiveness in minimizing time and expenses while ensuring compliance with the Carbon Border Adjustment Mechanism (CBAM) and the Clean Competition Act (CCA). User satisfaction was measured using the Kano model, with the results identifying essential features and prioritizing future enhancements. This study contributes a more comprehensive solution for SMEs seeking to achieve carbon neutrality, underscoring the transformative potential of blockchain technology in global carbon markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDecentralized P2P Trading based on Blockchain for Retail Electricity Markets

Masoud H. Nazari, Antar Kumar Biswas

Credit Blockchain for Faster Transactions in P2P Energy Trading

Yatindra Nath Singh, Amit kumar Vishwakarma

No citations found for this paper.

Comments (0)