Authors

Summary

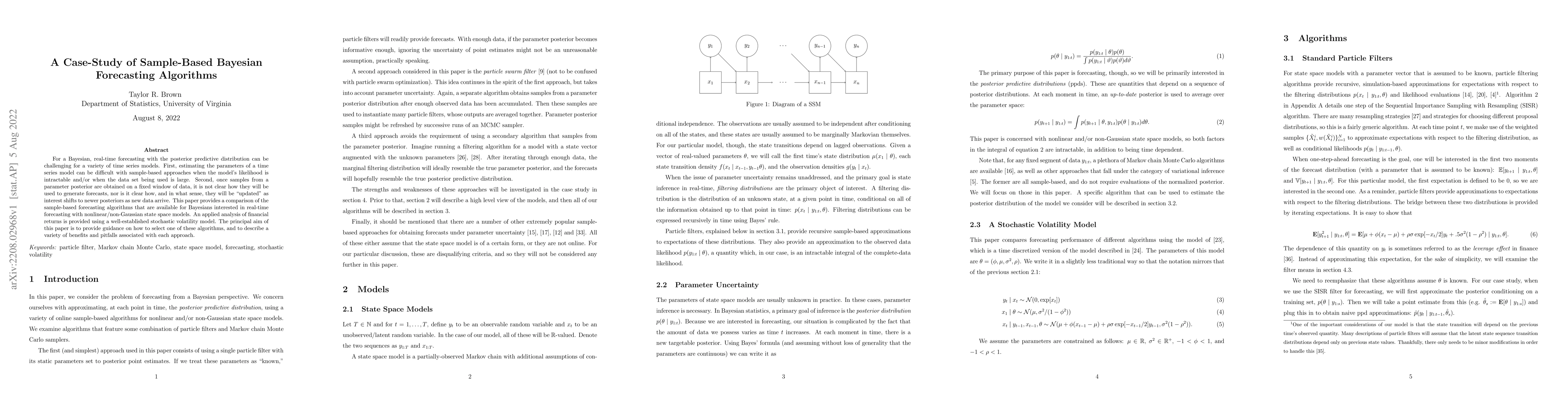

For a Bayesian, real-time forecasting with the posterior predictive distribution can be challenging for a variety of time series models. First, estimating the parameters of a time series model can be difficult with sample-based approaches when the model's likelihood is intractable and/or when the data set being used is large. Second, once samples from a parameter posterior are obtained on a fixed window of data, it is not clear how they will be used to generate forecasts, nor is it clear how, and in what sense, they will be ``updated" as interest shifts to newer posteriors as new data arrive. This paper provides a comparison of the sample-based forecasting algorithms that are available for Bayesians interested in real-time forecasting with nonlinear/non-Gaussian state space models. An applied analysis of financial returns is provided using a well-established stochastic volatility model. The principal aim of this paper is to provide guidance on how to select one of these algorithms, and to describe a variety of benefits and pitfalls associated with each approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Learning based Forecasting: a case study from the online fashion industry

Lei Ma, Zhen Li, Kashif Rasul et al.

No citations found for this paper.

Comments (0)