Summary

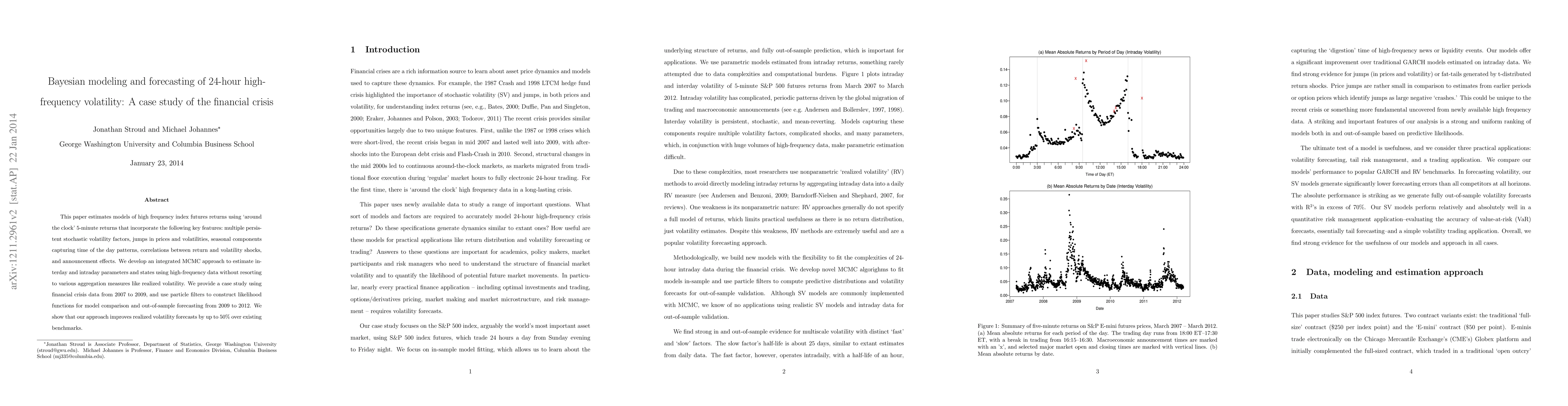

This paper estimates models of high frequency index futures returns using `around the clock' 5-minute returns that incorporate the following key features: multiple persistent stochastic volatility factors, jumps in prices and volatilities, seasonal components capturing time of the day patterns, correlations between return and volatility shocks, and announcement effects. We develop an integrated MCMC approach to estimate interday and intraday parameters and states using high-frequency data without resorting to various aggregation measures like realized volatility. We provide a case study using financial crisis data from 2007 to 2009, and use particle filters to construct likelihood functions for model comparison and out-of-sample forecasting from 2009 to 2012. We show that our approach improves realized volatility forecasts by up to 50% over existing benchmarks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBayesian identification of nonseparable Hamiltonians with multiplicative noise using deep learning and reduced-order modeling

Harsh Sharma, Boris Kramer, Nicholas Galioto et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)