Summary

We consider the problem of estimating $\mathbb{E} [f(U^1, \ldots, U^d)]$, where $(U^1, \ldots, U^d)$ denotes a random vector with uniformly distributed marginals. In general, Latin hypercube sampling (LHS) is a powerful tool for solving this kind of high-dimensional numerical integration problem. In the case of dependent components of the random vector $(U^1, \ldots, U^d)$ one can achieve more accurate results by using Latin hypercube sampling with dependence (LHSD). We state a central limit theorem for the $d$-dimensional LHSD estimator, by this means generalising a result of Packham and Schmidt. Furthermore we give conditions on the function $f$ and the distribution of $(U^1, \ldots, U^d)$ under which a reduction of variance can be achieved. Finally we compare the effectiveness of Monte Carlo and LHSD estimators numerically in exotic basket option pricing problems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

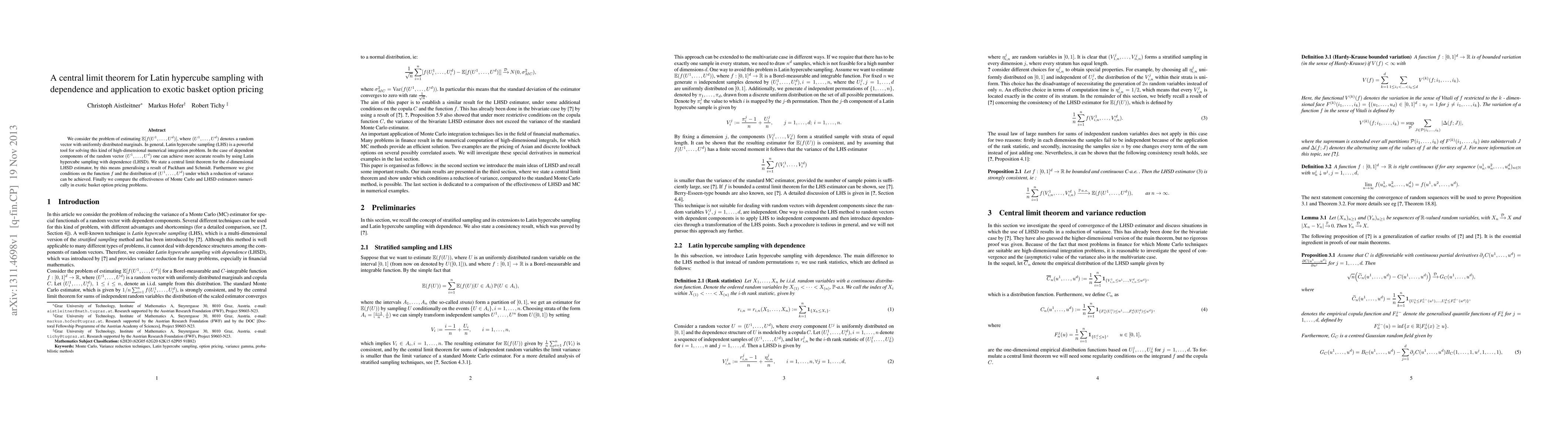

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust estimation with latin hypercube sampling: a central limit theorem for Z-estimators

Faouzi Hakimi

Boosting Binomial Exotic Option Pricing with Tensor Networks

Martin Ganahl, Maarten van Damme, Rishi Sreedhar

| Title | Authors | Year | Actions |

|---|

Comments (0)