Summary

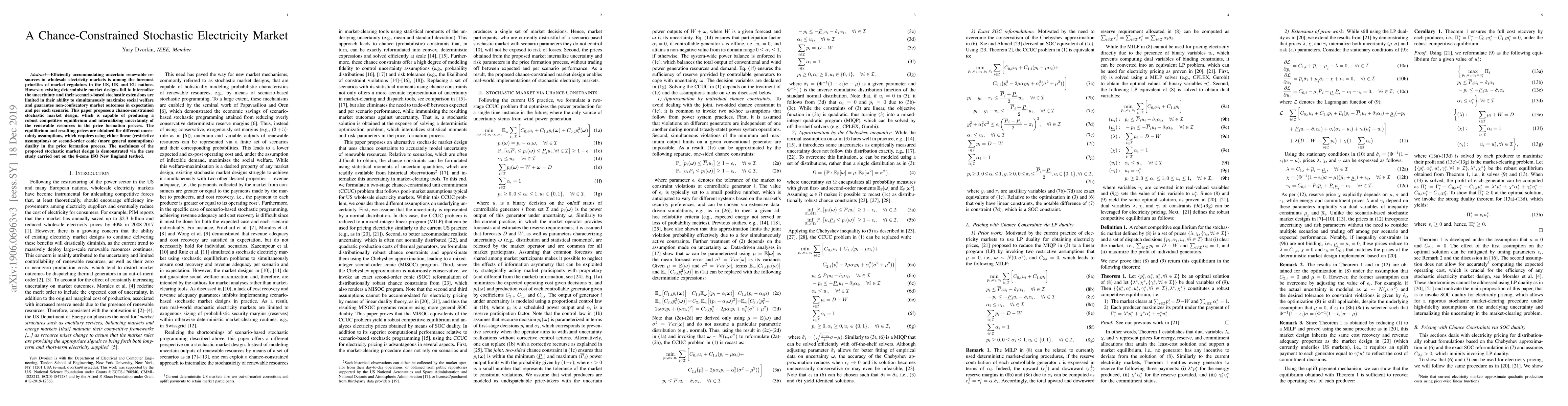

Efficiently accommodating uncertain renewable resources in wholesale electricity markets is among the foremost priorities of market regulators in the US, UK and EU nations. However, existing deterministic market designs fail to internalize the uncertainty and their scenario-based stochastic extensions are limited in their ability to simultaneously maximize social welfare and guarantee non-confiscatory market outcomes in expectation and per each scenario. This paper proposes a chance-constrained stochastic market design, which is capable of producing a robust competitive equilibrium and internalizing uncertainty of the renewable resources in the price formation process. The equilibrium and resulting prices are obtained for different uncertainty assumptions, which requires using either linear (restrictive assumptions) or second-order conic (more general assumptions) duality in the price formation process. The usefulness of the proposed stochastic market design is demonstrated via the case study carried out on the 8-zone ISO New England testbed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)