Summary

Existing electricity market designs assume risk neutrality and lack risk-hedging instruments, which leads to suboptimal market outcomes and reduces the overall market efficiency. This paper enables risk-trading in the chance-constrained stochastic electricity market by introducing Arrow-Debreu Securities (ADS) and derives a risk-averse market-clearing model with risk trading. To enable risk trading, the probability space of underlying uncertainty is discretized in a finite number of outcomes, which makes it possible to design practical risk contracts and to produce energy, balancing reserve and risk prices. Notably, although risk contracts are discrete, the model preserves the continuity of chance constraints. The case study illustrates the usefulness of the proposed risk-averse chance-constrained electricity market with risk trading.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

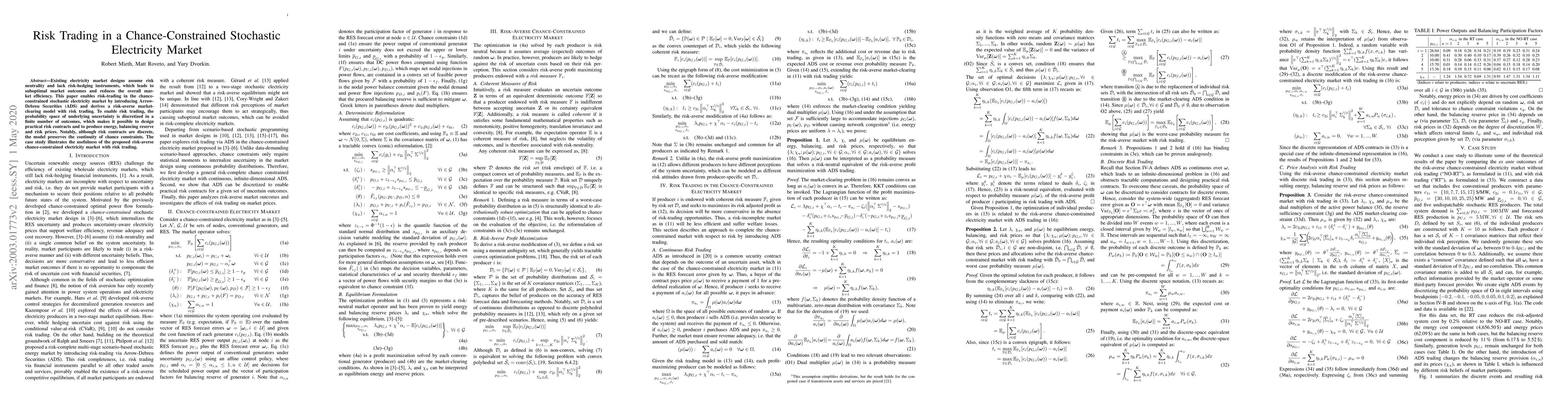

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Market Mechanism for Trading Flexibility Between Interconnected Electricity Markets

Alfredo Garcia, Ceyhun Eksin, Roohallah Khatami et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)