Authors

Summary

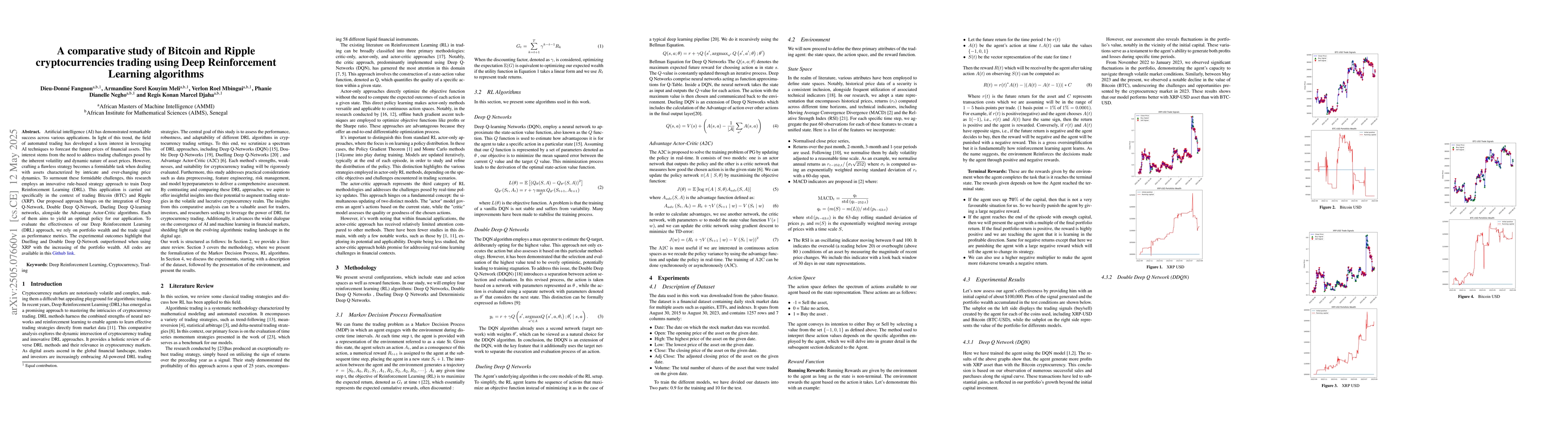

Artificial intelligence (AI) has demonstrated remarkable success across various applications. In light of this trend, the field of automated trading has developed a keen interest in leveraging AI techniques to forecast the future prices of financial assets. This interest stems from the need to address trading challenges posed by the inherent volatility and dynamic nature of asset prices. However, crafting a flawless strategy becomes a formidable task when dealing with assets characterized by intricate and ever-changing price dynamics. To surmount these formidable challenges, this research employs an innovative rule-based strategy approach to train Deep Reinforcement Learning (DRL). This application is carried out specifically in the context of trading Bitcoin (BTC) and Ripple (XRP). Our proposed approach hinges on the integration of Deep Q-Network, Double Deep Q-Network, Dueling Deep Q-learning networks, alongside the Advantage Actor-Critic algorithms. Each of them aims to yield an optimal policy for our application. To evaluate the effectiveness of our Deep Reinforcement Learning (DRL) approach, we rely on portfolio wealth and the trade signal as performance metrics. The experimental outcomes highlight that Duelling and Double Deep Q-Network outperformed when using XRP with the increasing of the portfolio wealth. All codes are available in this \href{https://github.com/VerlonRoelMBINGUI/RL_Final_Projects_AMMI2023}{\color{blue}Github link}.

AI Key Findings

Generated Jun 08, 2025

Methodology

The research employs Deep Reinforcement Learning (DRL) algorithms, specifically Deep Q-Network, Double Deep Q-Network, Dueling Deep Q-learning networks, and Advantage Actor-Critic, to develop a rule-based strategy for trading Bitcoin (BTC) and Ripple (XRP).

Key Results

- Dueling and Double Deep Q-Network outperformed other algorithms when trading Ripple (XRP), leading to increased portfolio wealth.

- The study demonstrates the effectiveness of DRL in handling the volatility and dynamic nature of cryptocurrency prices.

Significance

This research is significant as it applies AI techniques to address the challenges of cryptocurrency trading, providing a potentially more efficient automated trading strategy.

Technical Contribution

The integration and comparison of multiple DRL algorithms for cryptocurrency trading, providing a robust framework for automated trading strategies.

Novelty

This work stands out by specifically applying DRL to Bitcoin and Ripple, identifying Dueling and Double Deep Q-Network as superior algorithms for Ripple trading.

Limitations

- The study is limited to Bitcoin and Ripple, so its findings may not generalize to other cryptocurrencies.

- Performance evaluation relied on portfolio wealth and trade signals, potentially overlooking other important factors.

Future Work

- Further exploration of DRL algorithms for trading a wider range of cryptocurrencies.

- Investigating additional performance metrics beyond portfolio wealth and trade signals.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAlgorithmic Trading Using Continuous Action Space Deep Reinforcement Learning

Mahdi Shamsi, Farokh Marvasti, Naseh Majidi

A Framework for Empowering Reinforcement Learning Agents with Causal Analysis: Enhancing Automated Cryptocurrency Trading

Dhananjay Thiruvady, Asef Nazari, Rasoul Amirzadeh et al.

No citations found for this paper.

Comments (0)