Summary

This work aims to analyse the predictability of price movements of cryptocurrencies on both hourly and daily data observed from January 2017 to January 2021, using deep learning algorithms. For our experiments, we used three sets of features: technical, trading and social media indicators, considering a restricted model of only technical indicators and an unrestricted model with technical, trading and social media indicators. We verified whether the consideration of trading and social media indicators, along with the classic technical variables (such as price's returns), leads to a significative improvement in the prediction of cryptocurrencies price's changes. We conducted the study on the two highest cryptocurrencies in volume and value (at the time of the study): Bitcoin and Ethereum. We implemented four different machine learning algorithms typically used in time-series classification problems: Multi Layers Perceptron (MLP), Convolutional Neural Network (CNN), Long Short Term Memory (LSTM) neural network and Attention Long Short Term Memory (ALSTM). We devised the experiments using the advanced bootstrap technique to consider the variance problem on test samples, which allowed us to evaluate a more reliable estimate of the model's performance. Furthermore, the Grid Search technique was used to find the best hyperparameters values for each implemented algorithm. The study shows that, based on the hourly frequency results, the unrestricted model outperforms the restricted one. The addition of the trading indicators to the classic technical indicators improves the accuracy of Bitcoin and Ethereum price's changes prediction, with an increase of accuracy from a range of 51-55% for the restricted model, to 67-84% for the unrestricted model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

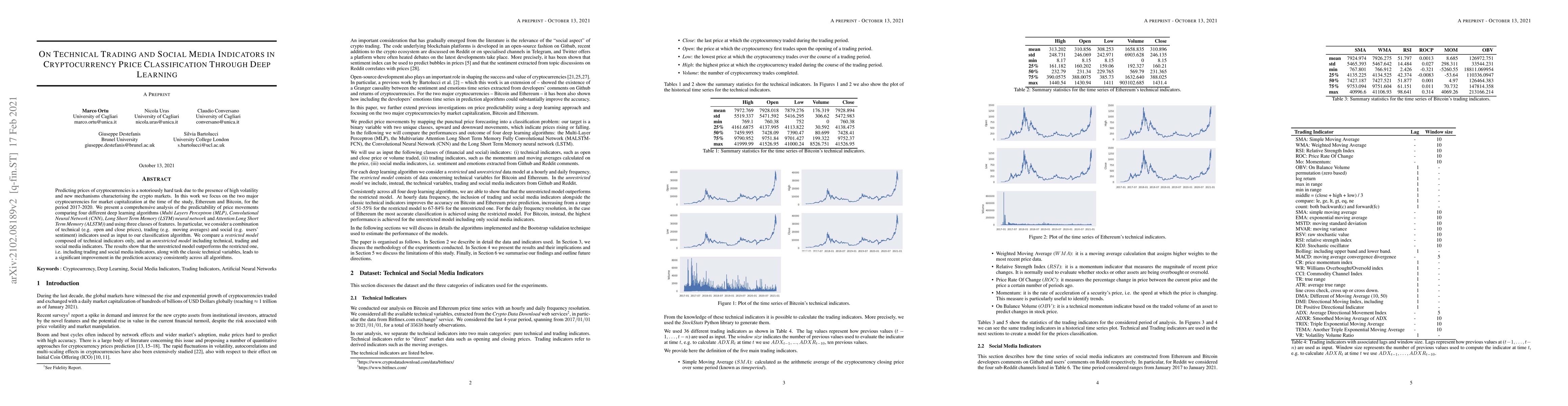

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersClassification-Based Analysis of Price Pattern Differences Between Cryptocurrencies and Stocks

Yu Zhang, Claudio Tessone, Zelin Wu

Assessing the Impact of Technical Indicators on Machine Learning Models for Stock Price Prediction

Chris Monico, Frank J. Fabozzi, Abootaleb Shirvani et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)