Summary

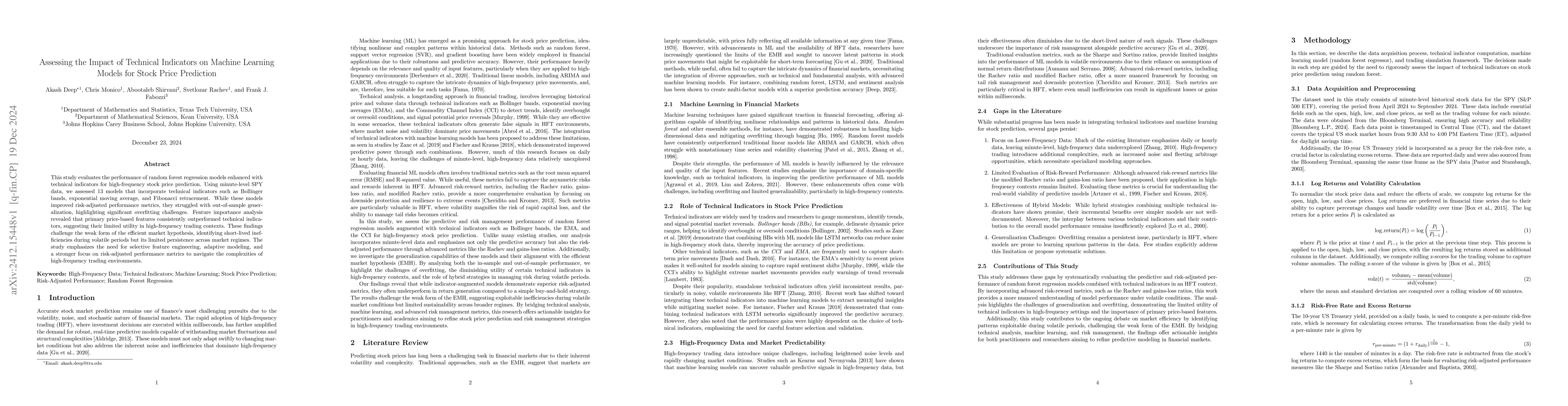

This study evaluates the performance of random forest regression models enhanced with technical indicators for high-frequency stock price prediction. Using minute-level SPY data, we assessed 13 models that incorporate technical indicators such as Bollinger bands, exponential moving average, and Fibonacci retracement. While these models improved risk-adjusted performance metrics, they struggled with out-of-sample generalization, highlighting significant overfitting challenges. Feature importance analysis revealed that primary price-based features consistently outperformed technical indicators, suggesting their limited utility in high-frequency trading contexts. These findings challenge the weak form of the efficient market hypothesis, identifying short-lived inefficiencies during volatile periods but its limited persistence across market regimes. The study emphasizes the need for selective feature engineering, adaptive modeling, and a stronger focus on risk-adjusted performance metrics to navigate the complexities of high-frequency trading environments.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersFeature selection and regression methods for stock price prediction using technical indicators

Fatemeh Moodi, Amir Jahangard-Rafsanjani, Sajad Zarifzadeh

Machine Learning for Stock Prediction Based on Fundamental Analysis

Luiz Fernando Capretz, Yuxuan Huang, Danny Ho

Stock Price Prediction Using Time Series, Econometric, Machine Learning, and Deep Learning Models

Jaydip Sen, Ananda Chatterjee, Hrisav Bhowmick

No citations found for this paper.

Comments (0)