Summary

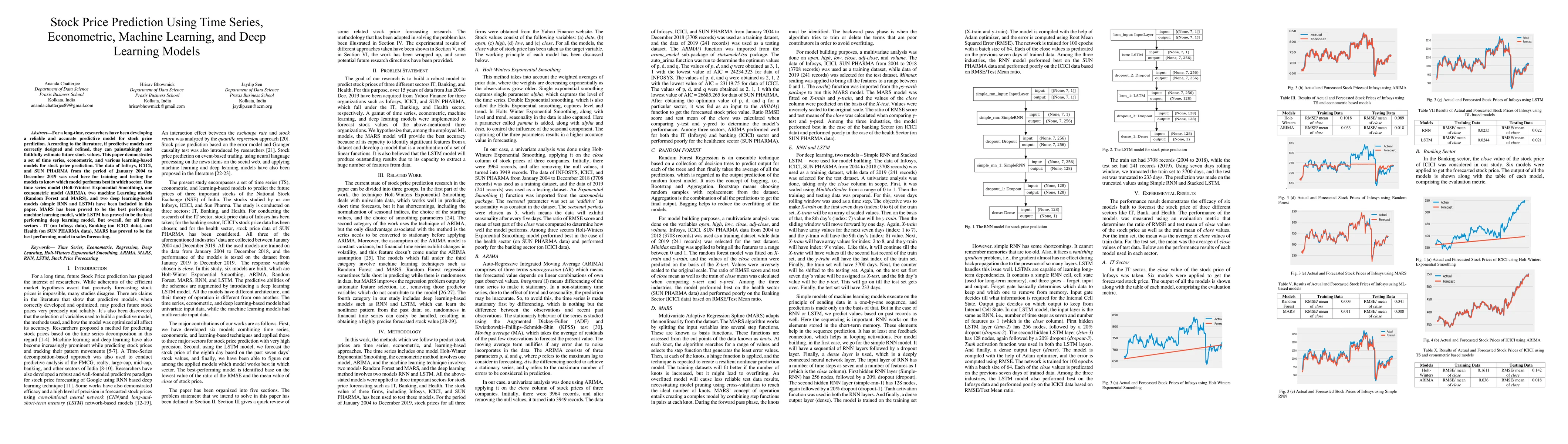

For a long-time, researchers have been developing a reliable and accurate predictive model for stock price prediction. According to the literature, if predictive models are correctly designed and refined, they can painstakingly and faithfully estimate future stock values. This paper demonstrates a set of time series, econometric, and various learning-based models for stock price prediction. The data of Infosys, ICICI, and SUN PHARMA from the period of January 2004 to December 2019 was used here for training and testing the models to know which model performs best in which sector. One time series model (Holt-Winters Exponential Smoothing), one econometric model (ARIMA), two machine Learning models (Random Forest and MARS), and two deep learning-based models (simple RNN and LSTM) have been included in this paper. MARS has been proved to be the best performing machine learning model, while LSTM has proved to be the best performing deep learning model. But overall, for all three sectors - IT (on Infosys data), Banking (on ICICI data), and Health (on SUN PHARMA data), MARS has proved to be the best performing model in sales forecasting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)