Jaydip Sen

49 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Saliency Attention and Semantic Similarity-Driven Adversarial Perturbation

In this paper, we introduce an enhanced textual adversarial attack method, known as Saliency Attention and Semantic Similarity driven adversarial Perturbation (SASSP). The proposed scheme is designed ...

Exploring Sectoral Profitability in the Indian Stock Market Using Deep Learning

This paper explores using a deep learning Long Short-Term Memory (LSTM) model for accurate stock price prediction and its implications for portfolio design. Despite the efficient market hypothesis s...

Boosting Digital Safeguards: Blending Cryptography and Steganography

In today's digital age, the internet is essential for communication and the sharing of information, creating a critical need for sophisticated data security measures to prevent unauthorized access a...

Semantic Stealth: Adversarial Text Attacks on NLP Using Several Methods

In various real-world applications such as machine translation, sentiment analysis, and question answering, a pivotal role is played by NLP models, facilitating efficient communication and decision-...

Evaluating Adversarial Robustness: A Comparison Of FGSM, Carlini-Wagner Attacks, And The Role of Distillation as Defense Mechanism

This technical report delves into an in-depth exploration of adversarial attacks specifically targeted at Deep Neural Networks (DNNs) utilized for image classification. The study also investigates d...

Generative AI-Based Text Generation Methods Using Pre-Trained GPT-2 Model

This work delved into the realm of automatic text generation, exploring a variety of techniques ranging from traditional deterministic approaches to more modern stochastic methods. Through analysis ...

Information Security and Privacy in the Digital World: Some Selected Topics

In the era of generative artificial intelligence and the Internet of Things, while there is explosive growth in the volume of data and the associated need for processing, analysis, and storage, seve...

A Modified Word Saliency-Based Adversarial Attack on Text Classification Models

This paper introduces a novel adversarial attack method targeting text classification models, termed the Modified Word Saliency-based Adversarial At-tack (MWSAA). The technique builds upon the conce...

Adversarial Attacks on Image Classification Models: Analysis and Defense

The notion of adversarial attacks on image classification models based on convolutional neural networks (CNN) is introduced in this work. To classify images, deep learning models called CNNs are fre...

A Comparative Study of Portfolio Optimization Methods for the Indian Stock Market

This chapter presents a comparative study of the three portfolio optimization methods, MVP, HRP, and HERC, on the Indian stock market, particularly focusing on the stocks chosen from 15 sectors list...

A Portfolio Rebalancing Approach for the Indian Stock Market

This chapter presents a calendar rebalancing approach to portfolios of stocks in the Indian stock market. Ten important sectors of the Indian economy are first selected. For each of these sectors, t...

Performance Evaluation of Equal-Weight Portfolio and Optimum Risk Portfolio on Indian Stocks

Designing an optimum portfolio for allocating suitable weights to its constituent assets so that the return and risk associated with the portfolio are optimized is a computationally hard problem. Th...

Portfolio Optimization: A Comparative Study

Portfolio optimization has been an area that has attracted considerable attention from the financial research community. Designing a profitable portfolio is a challenging task involving precise fore...

Adversarial Attacks on Image Classification Models: FGSM and Patch Attacks and their Impact

This chapter introduces the concept of adversarial attacks on image classification models built on convolutional neural networks (CNN). CNNs are very popular deep-learning models which are used in i...

Cryptography and Key Management Schemes for Wireless Sensor Networks

Wireless sensor networks (WSNs) are made up of a large number of tiny sensors, which can sense, analyze, and communicate information about the outside world. These networks play a significant role i...

A Comparative Analysis of Portfolio Optimization Using Mean-Variance, Hierarchical Risk Parity, and Reinforcement Learning Approaches on the Indian Stock Market

This paper presents a comparative analysis of the performances of three portfolio optimization approaches. Three approaches of portfolio optimization that are considered in this work are the mean-va...

Data Privacy Preservation on the Internet of Things

Recent developments in hardware and information technology have enabled the emergence of billions of connected, intelligent devices around the world exchanging information with minimal human involve...

A Framework of Customer Review Analysis Using the Aspect-Based Opinion Mining Approach

Opinion mining is the branch of computation that deals with opinions, appraisals, attitudes, and emotions of people and their different aspects. This field has attracted substantial research interes...

Designing Efficient Pair-Trading Strategies Using Cointegration for the Indian Stock Market

A pair-trading strategy is an approach that utilizes the fluctuations between prices of a pair of stocks in a short-term time frame, while in the long-term the pair may exhibit a strong association ...

Design and Analysis of Optimized Portfolios for Selected Sectors of the Indian Stock Market

Portfolio optimization is a challenging problem that has attracted considerable attention and effort from researchers. The optimization of stock portfolios is a particularly hard problem since the s...

Stock Volatility Prediction using Time Series and Deep Learning Approach

Volatility clustering is a crucial property that has a substantial impact on stock market patterns. Nonetheless, developing robust models for accurately predicting future stock price volatility is a...

A Comparative Study of Hierarchical Risk Parity Portfolio and Eigen Portfolio on the NIFTY 50 Stocks

Portfolio optimization has been an area of research that has attracted a lot of attention from researchers and financial analysts. Designing an optimum portfolio is a complex task since it not only ...

Stock Performance Evaluation for Portfolio Design from Different Sectors of the Indian Stock Market

The stock market offers a platform where people buy and sell shares of publicly listed companies. Generally, stock prices are quite volatile; hence predicting them is a daunting task. There is still...

Robust Portfolio Design and Stock Price Prediction Using an Optimized LSTM Model

Accurate prediction of future prices of stocks is a difficult task to perform. Even more challenging is to design an optimized portfolio with weights allocated to the stocks in a way that optimizes ...

Precise Stock Price Prediction for Optimized Portfolio Design Using an LSTM Model

Accurate prediction of future prices of stocks is a difficult task to perform. Even more challenging is to design an optimized portfolio of stocks with the identification of proper weights of alloca...

Hierarchical Risk Parity and Minimum Variance Portfolio Design on NIFTY 50 Stocks

Portfolio design and optimization have been always an area of research that has attracted a lot of attention from researchers from the finance domain. Designing an optimum portfolio is a complex tas...

Portfolio Optimization on NIFTY Thematic Sector Stocks Using an LSTM Model

Portfolio optimization has been a broad and intense area of interest for quantitative and statistical finance researchers and financial analysts. It is a challenging task to design a portfolio of st...

Precise Stock Price Prediction for Robust Portfolio Design from Selected Sectors of the Indian Stock Market

Stock price prediction is a challenging task and a lot of propositions exist in the literature in this area. Portfolio construction is a process of choosing a group of stocks and investing in them o...

Machine Learning: Algorithms, Models, and Applications

Recent times are witnessing rapid development in machine learning algorithm systems, especially in reinforcement learning, natural language processing, computer and robot vision, image processing, s...

Comprehensive Movie Recommendation System

A recommender system, also known as a recommendation system, is a type of information filtering system that attempts to forecast a user's rating or preference for an item. This article designs and i...

Analysis of Sectoral Profitability of the Indian Stock Market Using an LSTM Regression Model

Predictive model design for accurately predicting future stock prices has always been considered an interesting and challenging research problem. The task becomes complex due to the volatile and sto...

Stock Portfolio Optimization Using a Deep Learning LSTM Model

Predicting future stock prices and their movement patterns is a complex problem. Hence, building a portfolio of capital assets using the predicted prices to achieve the optimization between its retu...

Stock Price Prediction Using Time Series, Econometric, Machine Learning, and Deep Learning Models

For a long-time, researchers have been developing a reliable and accurate predictive model for stock price prediction. According to the literature, if predictive models are correctly designed and re...

Machine Learning in Finance-Emerging Trends and Challenges

The paradigm of machine learning and artificial intelligence has pervaded our everyday life in such a way that it is no longer an area for esoteric academics and scientists putting their effort to s...

Enhancing Adversarial Text Attacks on BERT Models with Projected Gradient Descent

Adversarial attacks against deep learning models represent a major threat to the security and reliability of natural language processing (NLP) systems. In this paper, we propose a modification to the ...

Analyzing Consumer Reviews for Understanding Drivers of Hotels Ratings: An Indian Perspective

In the internet era, almost every business entity is trying to have its digital footprint in digital media and other social media platforms. For these entities, word of mouse is also very important. P...

Robust Image Classification: Defensive Strategies against FGSM and PGD Adversarial Attacks

Adversarial attacks, particularly the Fast Gradient Sign Method (FGSM) and Projected Gradient Descent (PGD) pose significant threats to the robustness of deep learning models in image classification. ...

A Comparative Study of Hyperparameter Tuning Methods

The study emphasizes the challenge of finding the optimal trade-off between bias and variance, especially as hyperparameter optimization increases in complexity. Through empirical analysis, three hype...

Understanding the Impact of News Articles on the Movement of Market Index: A Case on Nifty 50

In the recent past, there were several works on the prediction of stock price using different methods. Sentiment analysis of news and tweets and relating them to the movement of stock prices have alre...

Privacy in Federated Learning

Federated Learning (FL) represents a significant advancement in distributed machine learning, enabling multiple participants to collaboratively train models without sharing raw data. This decentralize...

Adversarial Robustness through Dynamic Ensemble Learning

Adversarial attacks pose a significant threat to the reliability of pre-trained language models (PLMs) such as GPT, BERT, RoBERTa, and T5. This paper presents Adversarial Robustness through Dynamic En...

Context-Enhanced Contrastive Search for Improved LLM Text Generation

Recently, Large Language Models (LLMs) have demonstrated remarkable advancements in Natural Language Processing (NLP). However, generating high-quality text that balances coherence, diversity, and rel...

Advancing Decoding Strategies: Enhancements in Locally Typical Sampling for LLMs

This chapter explores advancements in decoding strategies for large language models (LLMs), focusing on enhancing the Locally Typical Sampling (LTS) algorithm. Traditional decoding methods, such as to...

Adversarial Text Generation with Dynamic Contextual Perturbation

Adversarial attacks on Natural Language Processing (NLP) models expose vulnerabilities by introducing subtle perturbations to input text, often leading to misclassification while maintaining human rea...

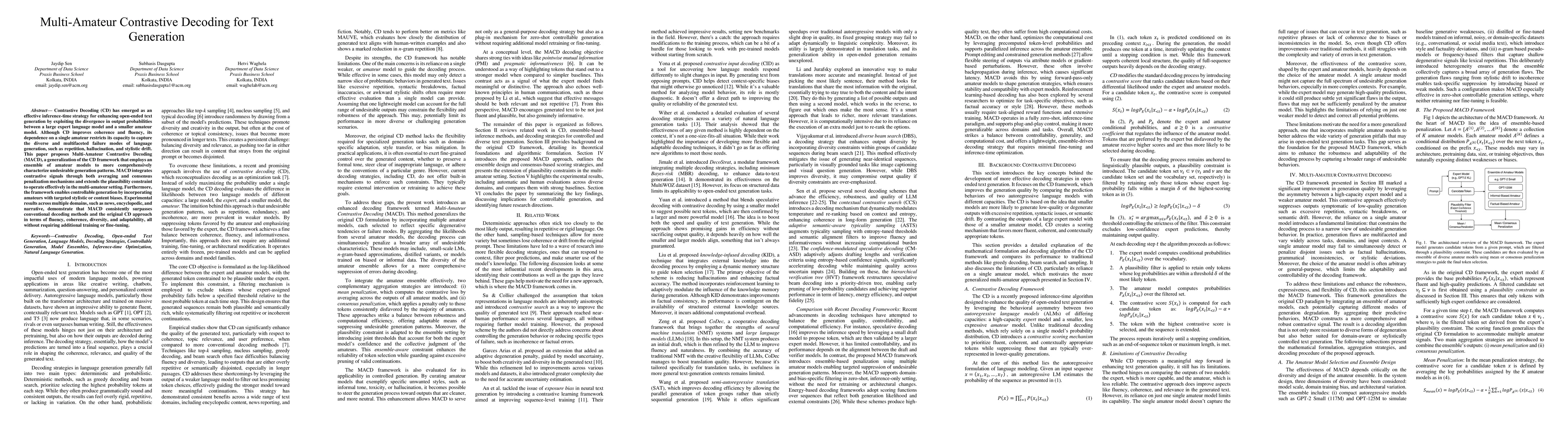

Determination Of Structural Cracks Using Deep Learning Frameworks

Structural crack detection is a critical task for public safety as it helps in preventing potential structural failures that could endanger lives. Manual detection by inexperienced personnel can be sl...

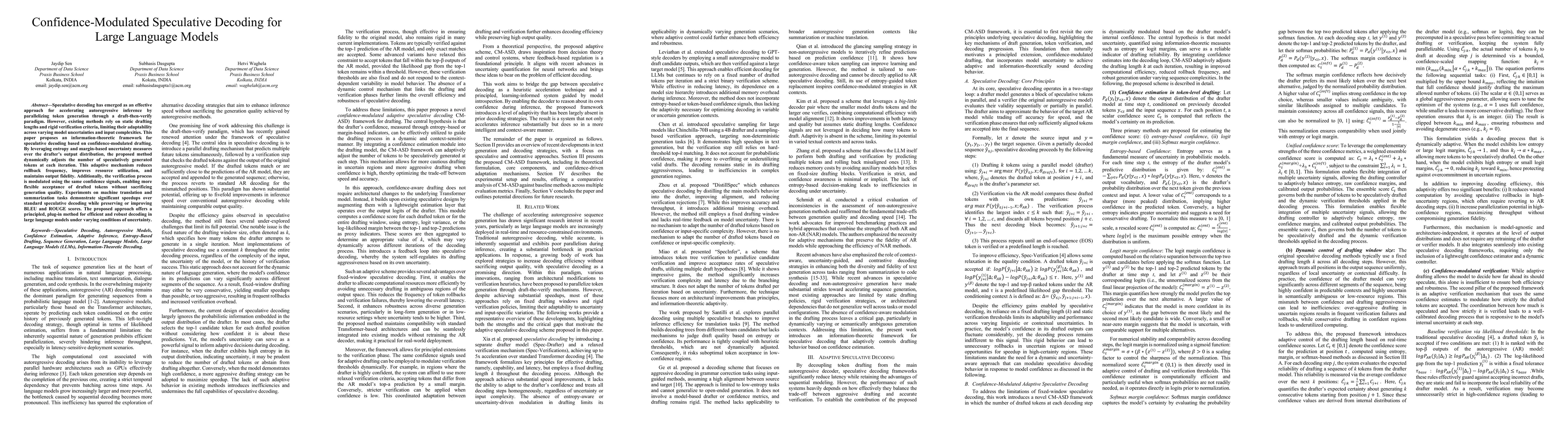

Multi-Amateur Contrastive Decoding for Text Generation

Contrastive Decoding (CD) has emerged as an effective inference-time strategy for enhancing open-ended text generation by exploiting the divergence in output probabilities between a large expert langu...

Hierarchical Verification of Speculative Beams for Accelerating LLM Inference

Large language models (LLMs) have achieved remarkable success across diverse natural language processing tasks but face persistent challenges in inference efficiency due to their autoregressive nature...

Confidence-Modulated Speculative Decoding for Large Language Models

Speculative decoding has emerged as an effective approach for accelerating autoregressive inference by parallelizing token generation through a draft-then-verify paradigm. However, existing methods re...

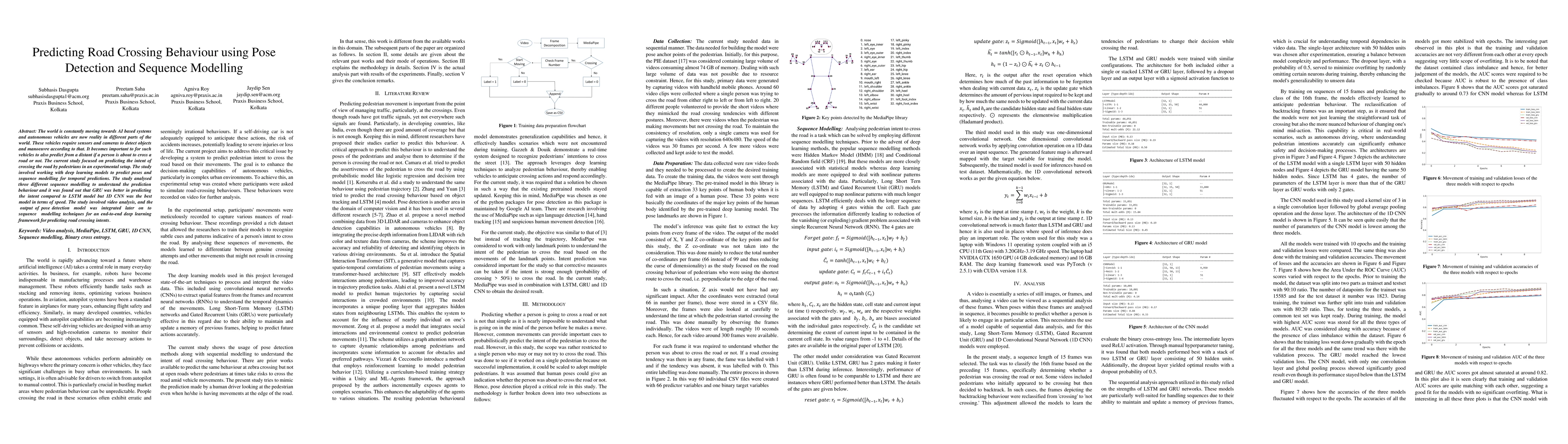

Predicting Road Crossing Behaviour using Pose Detection and Sequence Modelling

The world is constantly moving towards AI based systems and autonomous vehicles are now reality in different parts of the world. These vehicles require sensors and cameras to detect objects and maneuv...