Authors

Summary

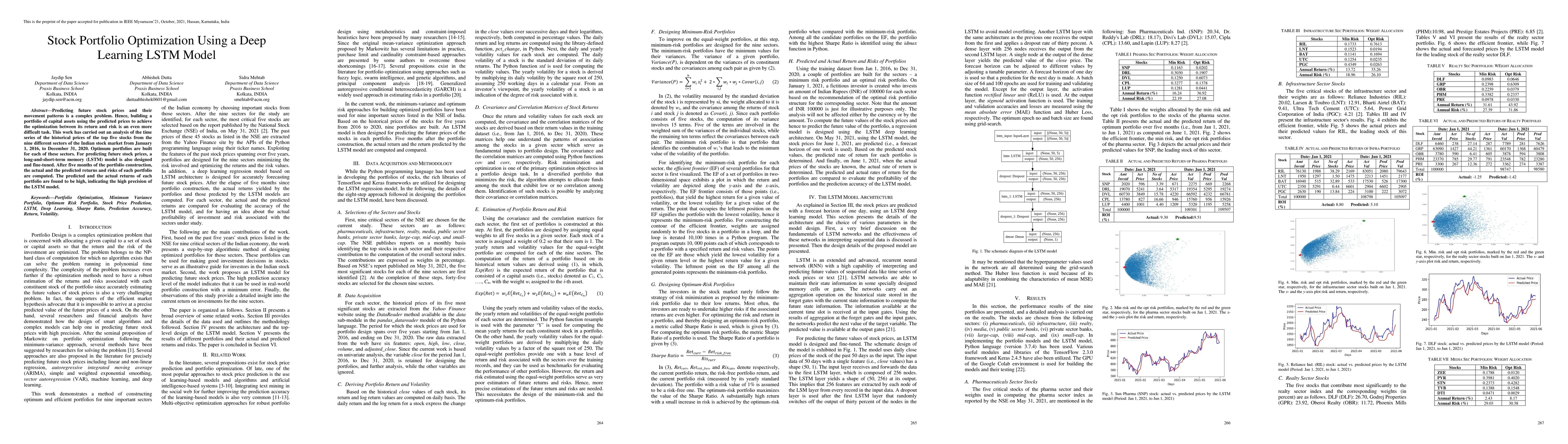

Predicting future stock prices and their movement patterns is a complex problem. Hence, building a portfolio of capital assets using the predicted prices to achieve the optimization between its return and risk is an even more difficult task. This work has carried out an analysis of the time series of the historical prices of the top five stocks from the nine different sectors of the Indian stock market from January 1, 2016, to December 31, 2020. Optimum portfolios are built for each of these sectors. For predicting future stock prices, a long-and-short-term memory (LSTM) model is also designed and fine-tuned. After five months of the portfolio construction, the actual and the predicted returns and risks of each portfolio are computed. The predicted and the actual returns of each portfolio are found to be high, indicating the high precision of the LSTM model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPortfolio Optimization on NIFTY Thematic Sector Stocks Using an LSTM Model

Jaydip Sen, Saikat Mondal, Sidra Mehtab

Precise Stock Price Prediction for Optimized Portfolio Design Using an LSTM Model

Abhishek Dutta, Jaydip Sen, Saikat Mondal et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)