Summary

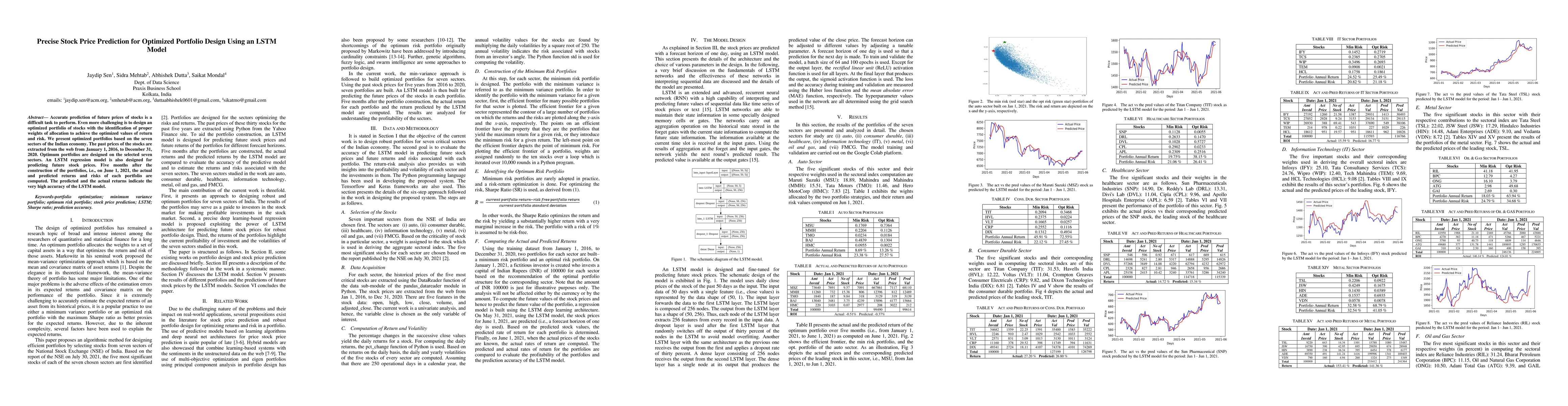

Accurate prediction of future prices of stocks is a difficult task to perform. Even more challenging is to design an optimized portfolio of stocks with the identification of proper weights of allocation to achieve the optimized values of return and risk. We present optimized portfolios based on the seven sectors of the Indian economy. The past prices of the stocks are extracted from the web from January 1, 2016, to December 31, 2020. Optimum portfolios are designed on the selected seven sectors. An LSTM regression model is also designed for predicting future stock prices. Five months after the construction of the portfolios, i.e., on June 1, 2021, the actual and predicted returns and risks of each portfolio are computed. The predicted and the actual returns indicate the very high accuracy of the LSTM model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust Portfolio Design and Stock Price Prediction Using an Optimized LSTM Model

Jaydip Sen, Saikat Mondal, Gourab Nath

Precise Stock Price Prediction for Robust Portfolio Design from Selected Sectors of the Indian Stock Market

Jaydip Sen, Ashwin Kumar R S, Geetha Joseph et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)