Authors

Summary

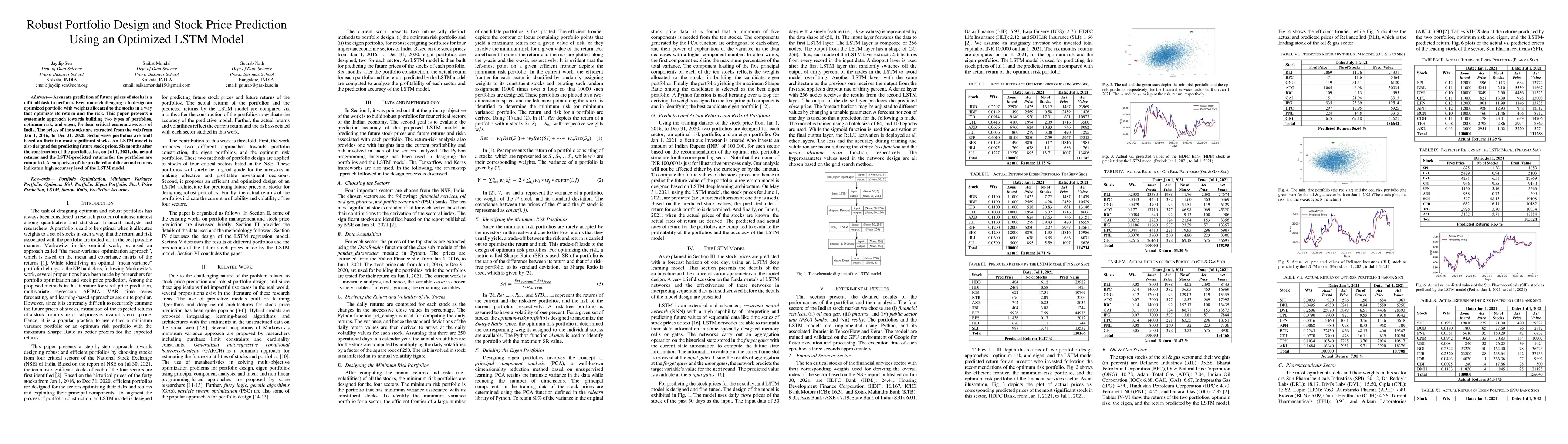

Accurate prediction of future prices of stocks is a difficult task to perform. Even more challenging is to design an optimized portfolio with weights allocated to the stocks in a way that optimizes its return and the risk. This paper presents a systematic approach towards building two types of portfolios, optimum risk, and eigen, for four critical economic sectors of India. The prices of the stocks are extracted from the web from Jan 1, 2016, to Dec 31, 2020. Sector-wise portfolios are built based on their ten most significant stocks. An LSTM model is also designed for predicting future stock prices. Six months after the construction of the portfolios, i.e., on Jul 1, 2021, the actual returns and the LSTM-predicted returns for the portfolios are computed. A comparison of the predicted and the actual returns indicate a high accuracy level of the LSTM model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPrecise Stock Price Prediction for Optimized Portfolio Design Using an LSTM Model

Abhishek Dutta, Jaydip Sen, Saikat Mondal et al.

Precise Stock Price Prediction for Robust Portfolio Design from Selected Sectors of the Indian Stock Market

Jaydip Sen, Ashwin Kumar R S, Geetha Joseph et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)