Summary

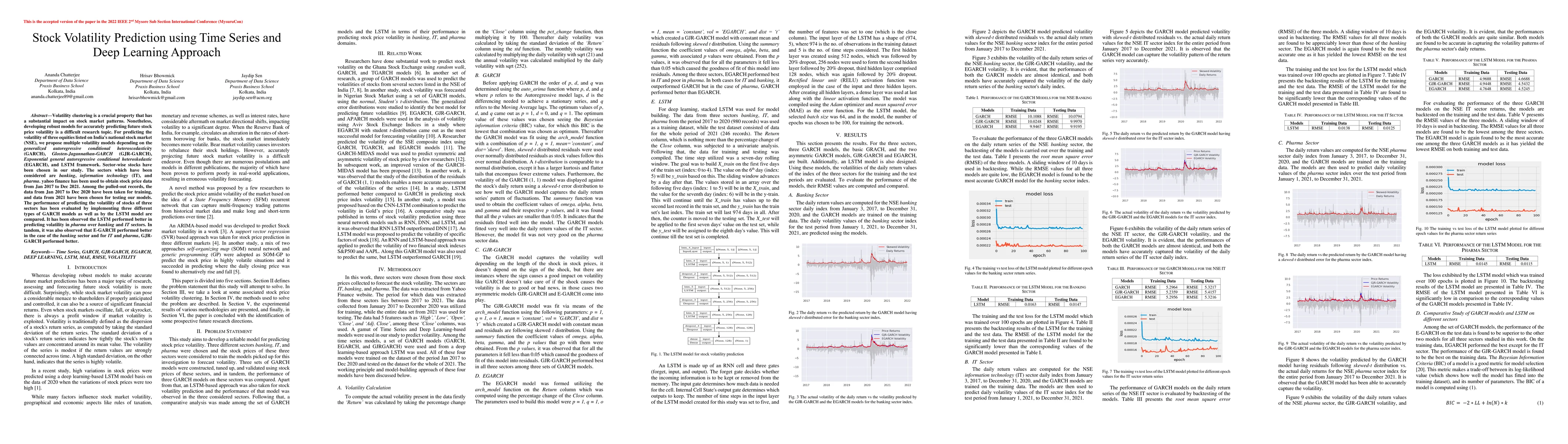

Volatility clustering is a crucial property that has a substantial impact on stock market patterns. Nonetheless, developing robust models for accurately predicting future stock price volatility is a difficult research topic. For predicting the volatility of three equities listed on India's national stock market (NSE), we propose multiple volatility models depending on the generalized autoregressive conditional heteroscedasticity (GARCH), Glosten-Jagannathan-GARCH (GJR-GARCH), Exponential general autoregressive conditional heteroskedastic (EGARCH), and LSTM framework. Sector-wise stocks have been chosen in our study. The sectors which have been considered are banking, information technology (IT), and pharma. yahoo finance has been used to obtain stock price data from Jan 2017 to Dec 2021. Among the pulled-out records, the data from Jan 2017 to Dec 2020 have been taken for training, and data from 2021 have been chosen for testing our models. The performance of predicting the volatility of stocks of three sectors has been evaluated by implementing three different types of GARCH models as well as by the LSTM model are compared. It has been observed the LSTM performed better in predicting volatility in pharma over banking and IT sectors. In tandem, it was also observed that E-GARCH performed better in the case of the banking sector and for IT and pharma, GJR-GARCH performed better.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)