Authors

Summary

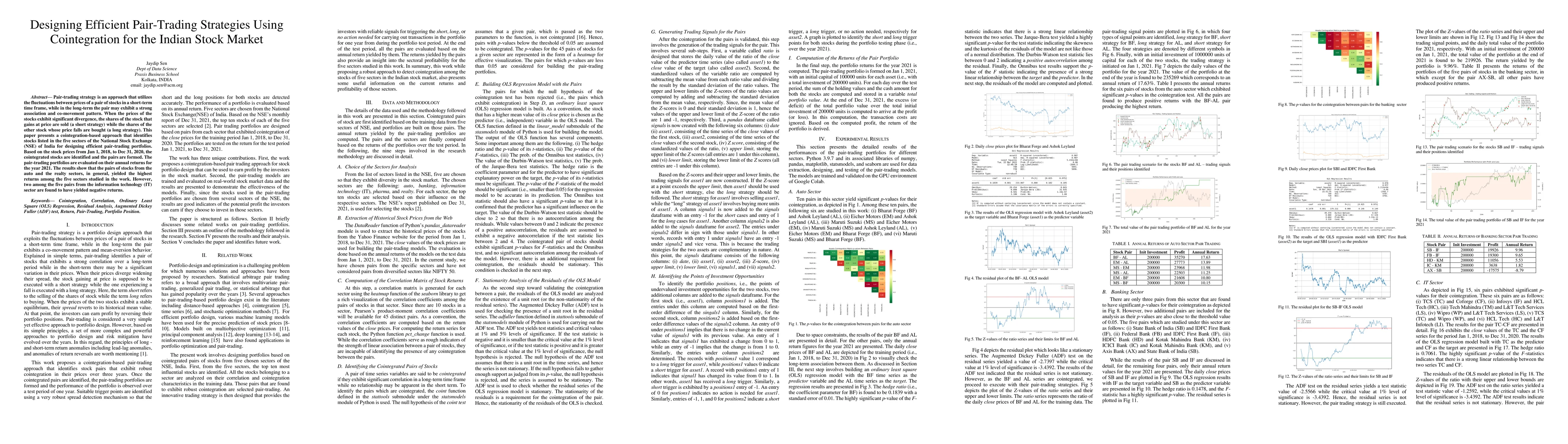

A pair-trading strategy is an approach that utilizes the fluctuations between prices of a pair of stocks in a short-term time frame, while in the long-term the pair may exhibit a strong association and co-movement pattern. When the prices of the stocks exhibit significant divergence, the shares of the stock that gains in price are sold (a short strategy) while the shares of the other stock whose price falls are bought (a long strategy). This paper presents a cointegration-based approach that identifies stocks listed in the five sectors of the National Stock Exchange (NSE) of India for designing efficient pair-trading portfolios. Based on the stock prices from Jan 1, 2018, to Dec 31, 2020, the cointegrated stocks are identified and the pairs are formed. The pair-trading portfolios are evaluated on their annual returns for the year 2021. The results show that the pairs of stocks from the auto and the realty sectors, in general, yielded the highest returns among the five sectors studied in the work. However, two among the five pairs from the information technology (IT) sector are found to have yielded negative returns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)