Authors

Summary

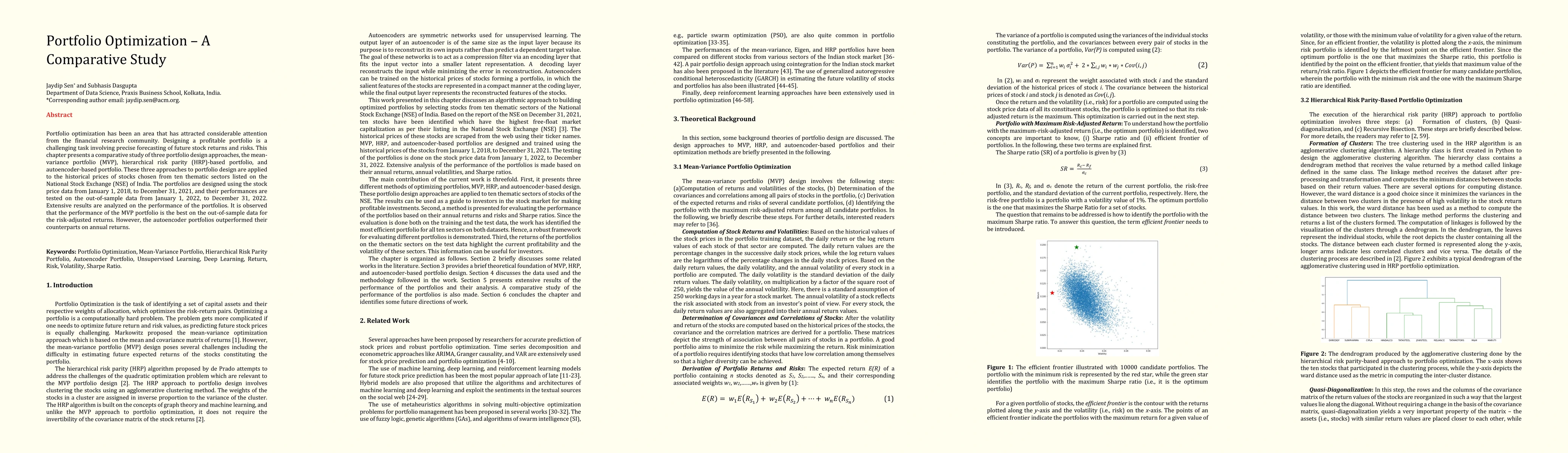

Portfolio optimization has been an area that has attracted considerable attention from the financial research community. Designing a profitable portfolio is a challenging task involving precise forecasting of future stock returns and risks. This chapter presents a comparative study of three portfolio design approaches, the mean-variance portfolio (MVP), hierarchical risk parity (HRP)-based portfolio, and autoencoder-based portfolio. These three approaches to portfolio design are applied to the historical prices of stocks chosen from ten thematic sectors listed on the National Stock Exchange (NSE) of India. The portfolios are designed using the stock price data from January 1, 2018, to December 31, 2021, and their performances are tested on the out-of-sample data from January 1, 2022, to December 31, 2022. Extensive results are analyzed on the performance of the portfolios. It is observed that the performance of the MVP portfolio is the best on the out-of-sample data for the risk-adjusted returns. However, the autoencoder portfolios outperformed their counterparts on annual returns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Comparative Study of Portfolio Optimization Methods for the Indian Stock Market

Jaydip Sen, Arup Dasgupta, Partha Pratim Sengupta et al.

Optimizing Portfolio Performance through Clustering and Sharpe Ratio-Based Optimization: A Comparative Backtesting Approach

Keon Vin Park

A Comparative Study of Hierarchical Risk Parity Portfolio and Eigen Portfolio on the NIFTY 50 Stocks

Abhishek Dutta, Jaydip Sen

| Title | Authors | Year | Actions |

|---|

Comments (0)