Summary

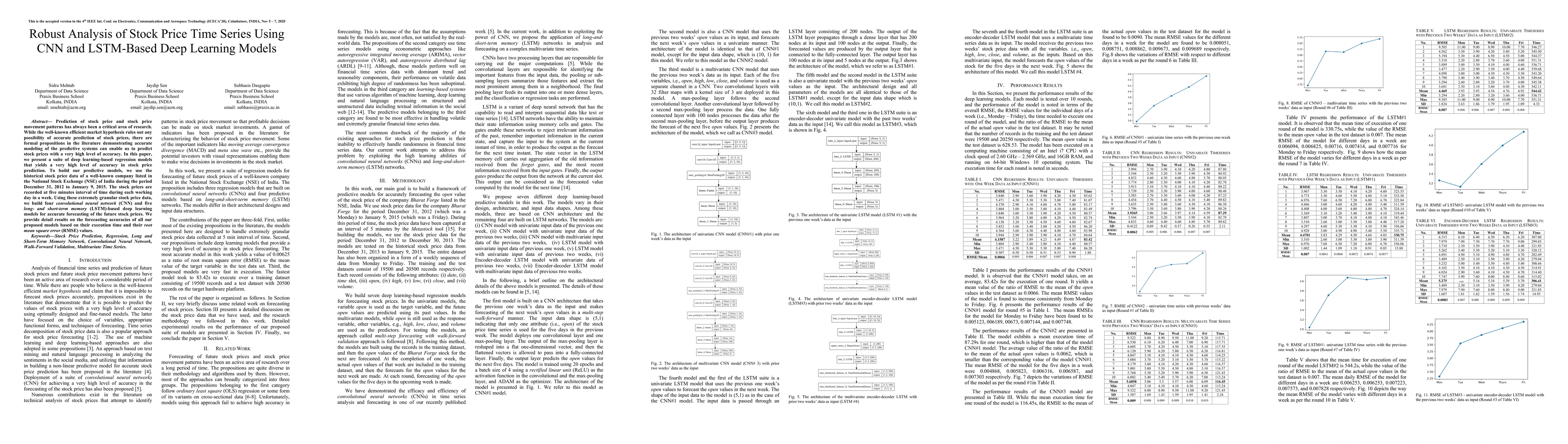

Prediction of stock price and stock price movement patterns has always been a critical area of research. While the well-known efficient market hypothesis rules out any possibility of accurate prediction of stock prices, there are formal propositions in the literature demonstrating accurate modeling of the predictive systems that can enable us to predict stock prices with a very high level of accuracy. In this paper, we present a suite of deep learning-based regression models that yields a very high level of accuracy in stock price prediction. To build our predictive models, we use the historical stock price data of a well-known company listed in the National Stock Exchange (NSE) of India during the period December 31, 2012 to January 9, 2015. The stock prices are recorded at five minutes intervals of time during each working day in a week. Using these extremely granular stock price data, we build four convolutional neural network (CNN) and five long- and short-term memory (LSTM)-based deep learning models for accurate forecasting of the future stock prices. We provide detailed results on the forecasting accuracies of all our proposed models based on their execution time and their root mean square error (RMSE) values.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStock Price Prediction Using Time Series, Econometric, Machine Learning, and Deep Learning Models

Jaydip Sen, Ananda Chatterjee, Hrisav Bhowmick

| Title | Authors | Year | Actions |

|---|

Comments (0)