Summary

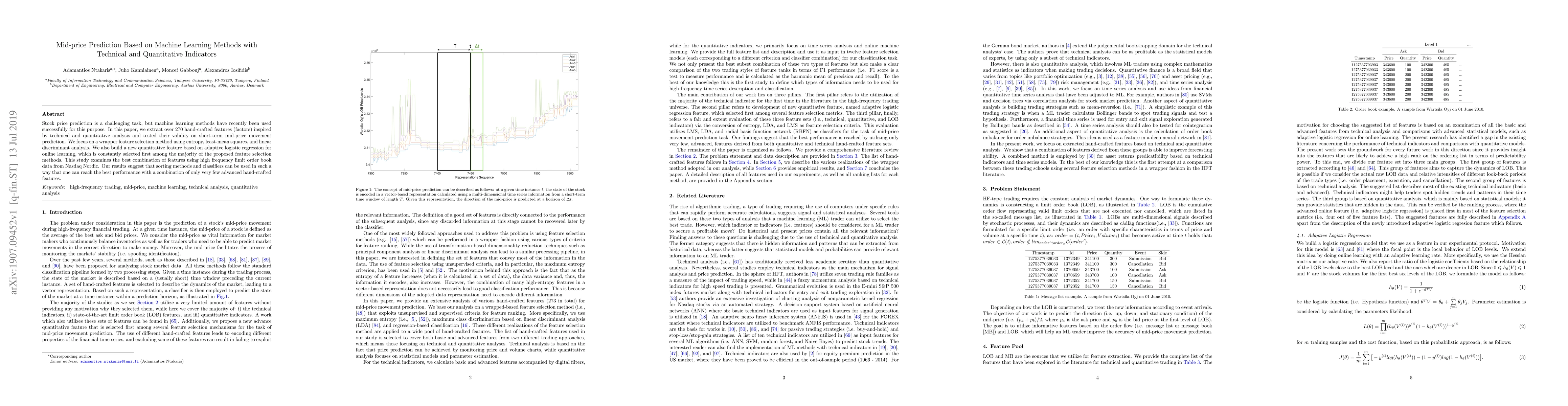

Stock price prediction is a challenging task, but machine learning methods have recently been used successfully for this purpose. In this paper, we extract over 270 hand-crafted features (factors) inspired by technical and quantitative analysis and tested their validity on short-term mid-price movement prediction. We focus on a wrapper feature selection method using entropy, least-mean squares, and linear discriminant analysis. We also build a new quantitative feature based on adaptive logistic regression for online learning, which is constantly selected first among the majority of the proposed feature selection methods. This study examines the best combination of features using high frequency limit order book data from Nasdaq Nordic. Our results suggest that sorting methods and classifiers can be used in such a way that one can reach the best performance with a combination of only very few advanced hand-crafted features.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFeature selection and regression methods for stock price prediction using technical indicators

Fatemeh Moodi, Amir Jahangard-Rafsanjani, Sajad Zarifzadeh

Assessing the Impact of Technical Indicators on Machine Learning Models for Stock Price Prediction

Chris Monico, Frank J. Fabozzi, Abootaleb Shirvani et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)