Summary

Application of machine learning for stock prediction is attracting a lot of attention in recent years. A large amount of research has been conducted in this area and multiple existing results have shown that machine learning methods could be successfully used toward stock predicting using stocks historical data. Most of these existing approaches have focused on short term prediction using stocks historical price and technical indicators. In this paper, we prepared 22 years worth of stock quarterly financial data and investigated three machine learning algorithms: Feed-forward Neural Network (FNN), Random Forest (RF) and Adaptive Neural Fuzzy Inference System (ANFIS) for stock prediction based on fundamental analysis. In addition, we applied RF based feature selection and bootstrap aggregation in order to improve model performance and aggregate predictions from different models. Our results show that RF model achieves the best prediction results, and feature selection is able to improve test performance of FNN and ANFIS. Moreover, the aggregated model outperforms all baseline models as well as the benchmark DJIA index by an acceptable margin for the test period. Our findings demonstrate that machine learning models could be used to aid fundamental analysts with decision-making regarding stock investment.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

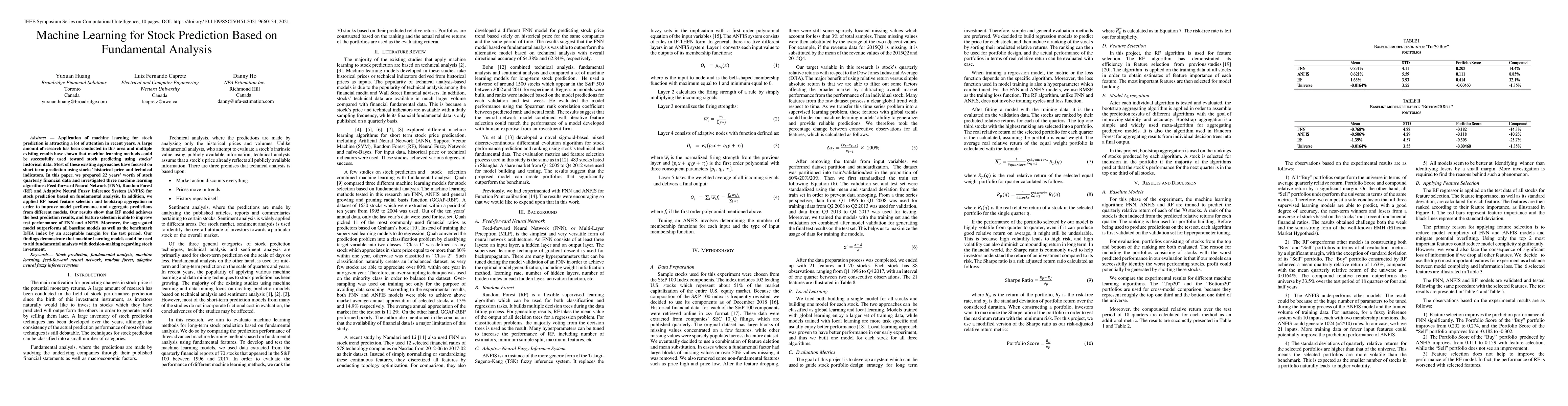

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)