Authors

Summary

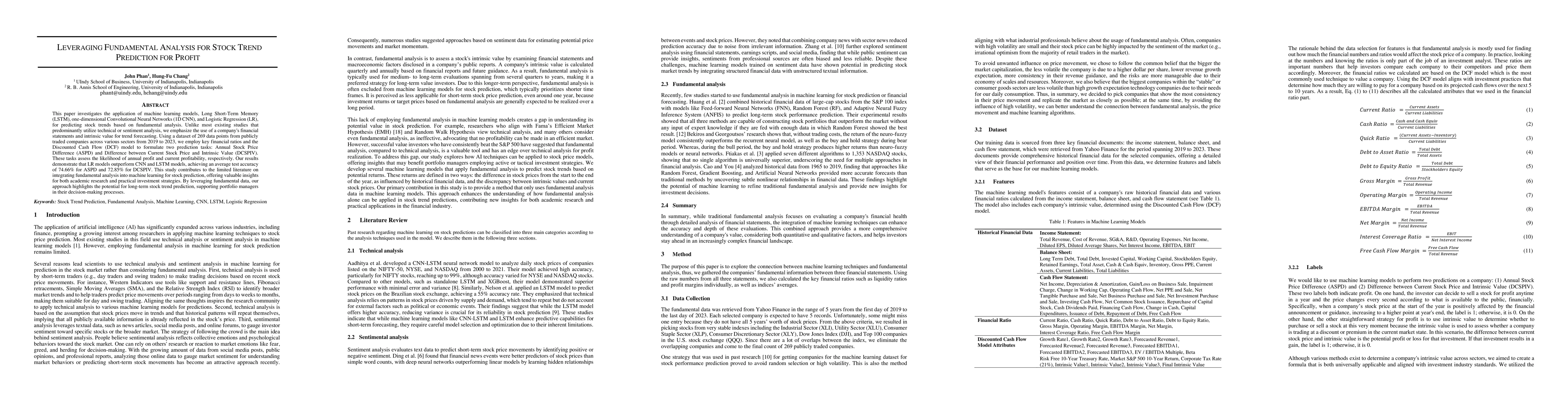

This paper investigates the application of machine learning models, Long Short-Term Memory (LSTM), one-dimensional Convolutional Neural Networks (1D CNN), and Logistic Regression (LR), for predicting stock trends based on fundamental analysis. Unlike most existing studies that predominantly utilize technical or sentiment analysis, we emphasize the use of a company's financial statements and intrinsic value for trend forecasting. Using a dataset of 269 data points from publicly traded companies across various sectors from 2019 to 2023, we employ key financial ratios and the Discounted Cash Flow (DCF) model to formulate two prediction tasks: Annual Stock Price Difference (ASPD) and Difference between Current Stock Price and Intrinsic Value (DCSPIV). These tasks assess the likelihood of annual profit and current profitability, respectively. Our results demonstrate that LR models outperform CNN and LSTM models, achieving an average test accuracy of 74.66% for ASPD and 72.85% for DCSPIV. This study contributes to the limited literature on integrating fundamental analysis into machine learning for stock prediction, offering valuable insights for both academic research and practical investment strategies. By leveraging fundamental data, our approach highlights the potential for long-term stock trend prediction, supporting portfolio managers in their decision-making processes.

AI Key Findings

Generated Sep 05, 2025

Methodology

This study explores the application of machine learning models (LSTM, CNN, and logistic regression) to predict stock trends based on fundamental analysis.

Key Results

- Accuracy rates close to 72% achieved using LSTM, CNN, and logistic regression models

- Main finding: Machine learning models can better capture market behavior than traditional technical analysis methods

- Improved profitability for investors by selecting stocks based on traditional fundamental analysis techniques

Significance

This research provides valuable insights for both industry professionals and academic researchers, highlighting the potential of machine learning models in long-term stock market prediction.

Technical Contribution

The main technical contribution of this work is the development and evaluation of machine learning models for stock price prediction based on fundamental analysis.

Novelty

This research novelizes the application of machine learning models in long-term stock market prediction, providing a more profitable strategy for investors

Limitations

- Dataset size and scope limited, potentially hindering the models' ability to capture long-term trends

- Number of stocks chosen for analysis relatively small, which may limit the models' applicability to different sectors

Future Work

- Expanding dataset to cover a broader time span to improve generalizability across various market conditions

- Customizing model parameters for specific industries to enhance accuracy and relevance

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSupport for Stock Trend Prediction Using Transformers and Sentiment Analysis

Ye Qiao, Nader Bagherzadeh, Harsimrat Kaeley

Machine Learning for Stock Prediction Based on Fundamental Analysis

Luiz Fernando Capretz, Yuxuan Huang, Danny Ho

No citations found for this paper.

Comments (0)