Authors

Summary

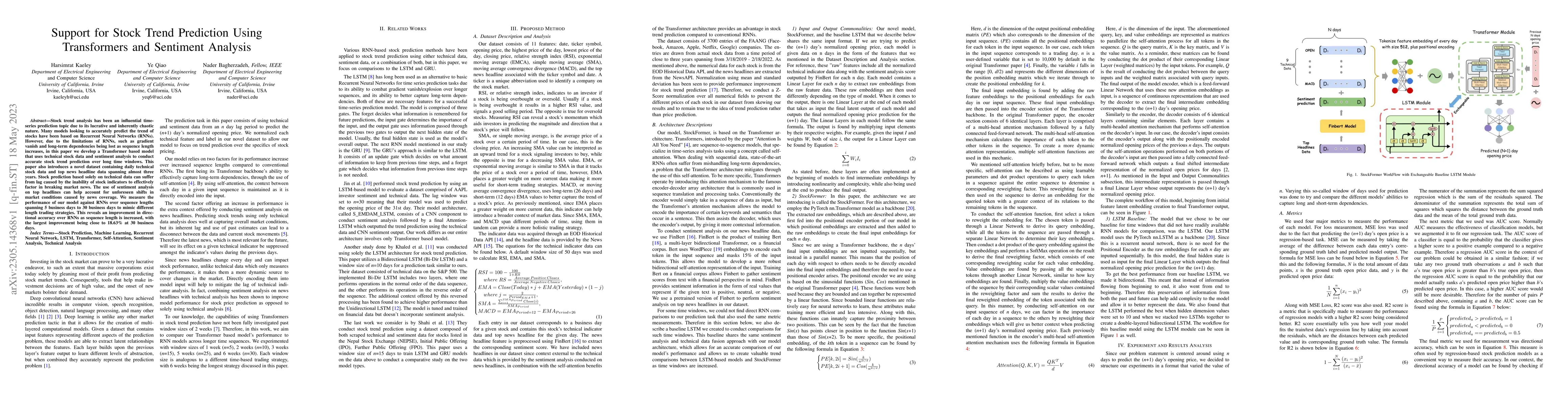

Stock trend analysis has been an influential time-series prediction topic due to its lucrative and inherently chaotic nature. Many models looking to accurately predict the trend of stocks have been based on Recurrent Neural Networks (RNNs). However, due to the limitations of RNNs, such as gradient vanish and long-term dependencies being lost as sequence length increases, in this paper we develop a Transformer based model that uses technical stock data and sentiment analysis to conduct accurate stock trend prediction over long time windows. This paper also introduces a novel dataset containing daily technical stock data and top news headline data spanning almost three years. Stock prediction based solely on technical data can suffer from lag caused by the inability of stock indicators to effectively factor in breaking market news. The use of sentiment analysis on top headlines can help account for unforeseen shifts in market conditions caused by news coverage. We measure the performance of our model against RNNs over sequence lengths spanning 5 business days to 30 business days to mimic different length trading strategies. This reveals an improvement in directional accuracy over RNNs as sequence length is increased, with the largest improvement being close to 18.63% at 30 business days.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)