Svetlozar Rachev

9 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Beyond the Bid-Ask: Strategic Insights into Spread Prediction and the Global Mid-Price Phenomenon

This study introduces novel concepts in the analysis of limit order books (LOBs) with a focus on unveiling strategic insights into spread prediction and understanding the global mid-price (GMP) phen...

The Financial Market of Environmental Indices

This paper introduces the concept of a global financial market for environmental indices, addressing sustainability concerns and aiming to attract institutional investors. Risk mitigation measures a...

Exploring Implied Certainty Equivalent Rates in Financial Markets: Empirical Analysis and Application to the Electric Vehicle Industry

In this paper, we mainly study the impact of the implied certainty equivalent rate on investment in financial markets. First, we derived the mathematical expression of the implied certainty equivale...

Exploring Dynamic Asset Pricing within Bachelier Market Model

This paper delves into the dynamics of asset pricing within Bachelier market model, elucidating the representation of risky asset price dynamics and the definition of riskless assets.

The Implied Views of Bond Traders on the Spot Equity Market

This study delves into the temporal dynamics within the equity market through the lens of bond traders. Recognizing that the riskless interest rate fluctuates over time, we leverage the Black-Derman...

Bachelier's Market Model for ESG Asset Pricing

Environmental, Social, and Governance (ESG) finance is a cornerstone of modern finance and investment, as it changes the classical return-risk view of investment by incorporating an additional dimen...

The Financial Market of Indices of Socioeconomic Wellbeing

The financial industry should be involved in mitigating the risk of downturns in the financial wellbeing indices around the world by implementing well-developed financial tools such as insurance ins...

Assessing the Impact of Technical Indicators on Machine Learning Models for Stock Price Prediction

This study evaluates the performance of random forest regression models enhanced with technical indicators for high-frequency stock price prediction. Using minute-level SPY data, we assessed 13 models...

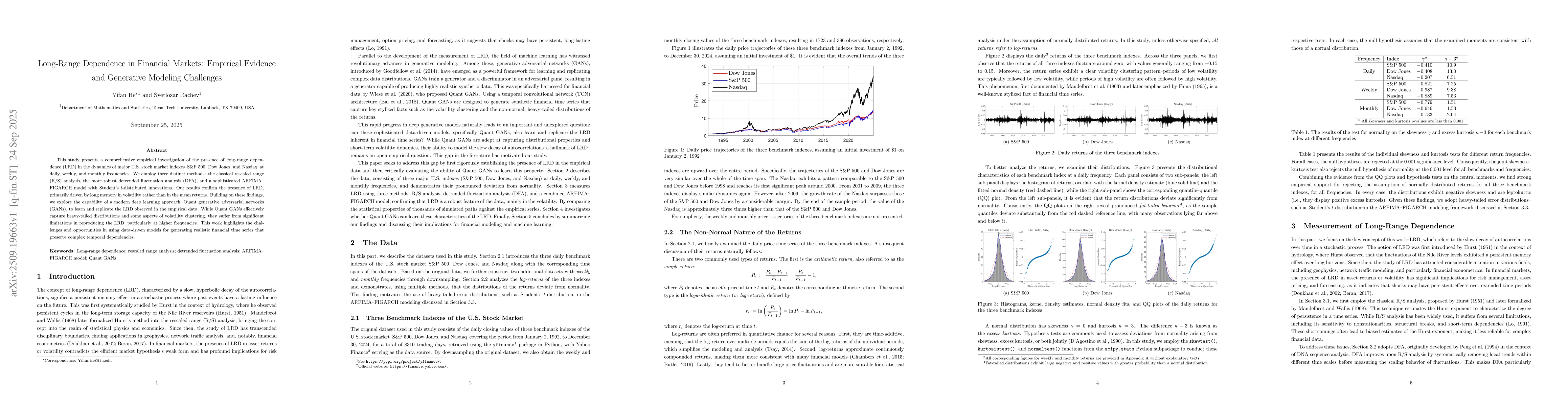

Long-Range Dependence in Financial Markets: Empirical Evidence and Generative Modeling Challenges

This study presents a comprehensive empirical investigation of the presence of long-range dependence (LRD) in the dynamics of major U.S. stock market indexes--S\&P 500, Dow Jones, and Nasdaq--at daily...