Summary

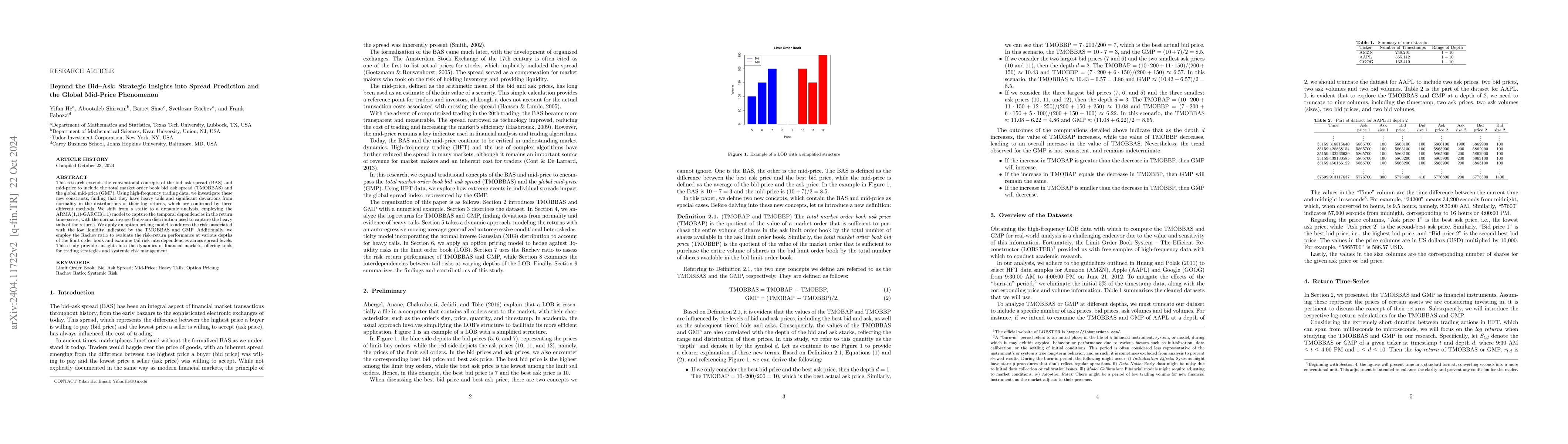

This study introduces novel concepts in the analysis of limit order books (LOBs) with a focus on unveiling strategic insights into spread prediction and understanding the global mid-price (GMP) phenomenon. We define and analyze the total market order book bid--ask spread (TMOBBAS) and GMP, showcasing their significance in providing a deeper understanding of market dynamics beyond traditional LOB models. Employing high-frequency data, we comprehensively examine these concepts through various methodological lenses, including tail behavior analysis, dynamics of log-returns, and risk--return performance evaluation. Our findings reveal the intricate behavior of TMOBBAS and GMP under different market conditions, offering new perspectives on the liquidity, volatility, and efficiency of markets. This paper not only contributes to the academic discourse on financial markets but also presents practical implications for traders, risk managers, and policymakers seeking to navigate the complexities of modern financial systems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersThe self-exciting nature of the bid-ask spread dynamics

Emmanuel Bacry, Jean-François Muzy, Ruihua Ruan

No citations found for this paper.

Comments (0)