Summary

We derive a continuous time model for the joint evolution of the mid price and the bid-ask spread from a multiscale analysis of the whole limit order book (LOB) dynamics. We model the LOB as a multiclass queueing system and perform our asymptotic analysis using stylized features observed empirically. We argue that in the asymptotic regime supported by empirical observations the mid price and bid-ask-spread can be described using only certain parameters of the book (not the whole book itself). Our limit process is characterized by reflecting behavior and state-dependent jumps. Our analysis allows to explain certain characteristics observed in practice such as: the connection between power-law decaying tails in the volumes of the order book and the returns, as well as statistical properties of the long-run spread distribution.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

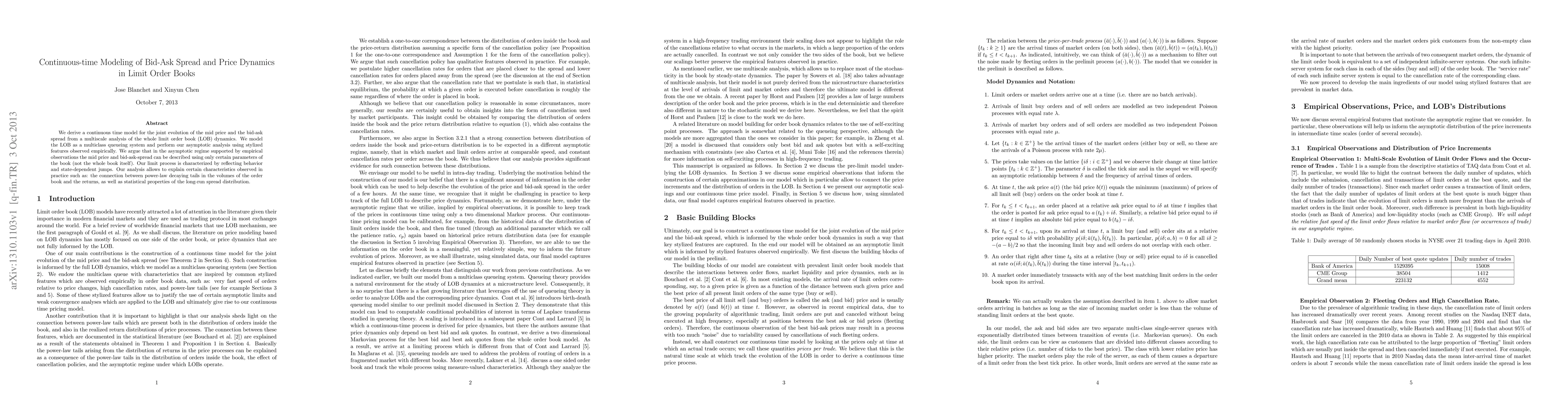

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe self-exciting nature of the bid-ask spread dynamics

Emmanuel Bacry, Jean-François Muzy, Ruihua Ruan

Beyond the Bid-Ask: Strategic Insights into Spread Prediction and the Global Mid-Price Phenomenon

Yifan He, Abootaleb Shirvani, Barret Shao et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)