Summary

The bid-ask spread, which is defined by the difference between the best selling price and the best buying price in a Limit Order Book at a given time, is a crucial factor in the analysis of financial securities. In this study, we propose a "State-dependent Spread Hawkes model" (SDSH) that accounts for various spread jump sizes and incorporates the impact of the current spread state on its intensity functions. We apply this model to the high-frequency data from the Cac40 Euronext market and capture several statistical properties, such as the spread distributions, inter-event time distributions, and spread autocorrelation functions. We illustrate the ability of the SDSH model to forecast spread values at short-term horizons.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

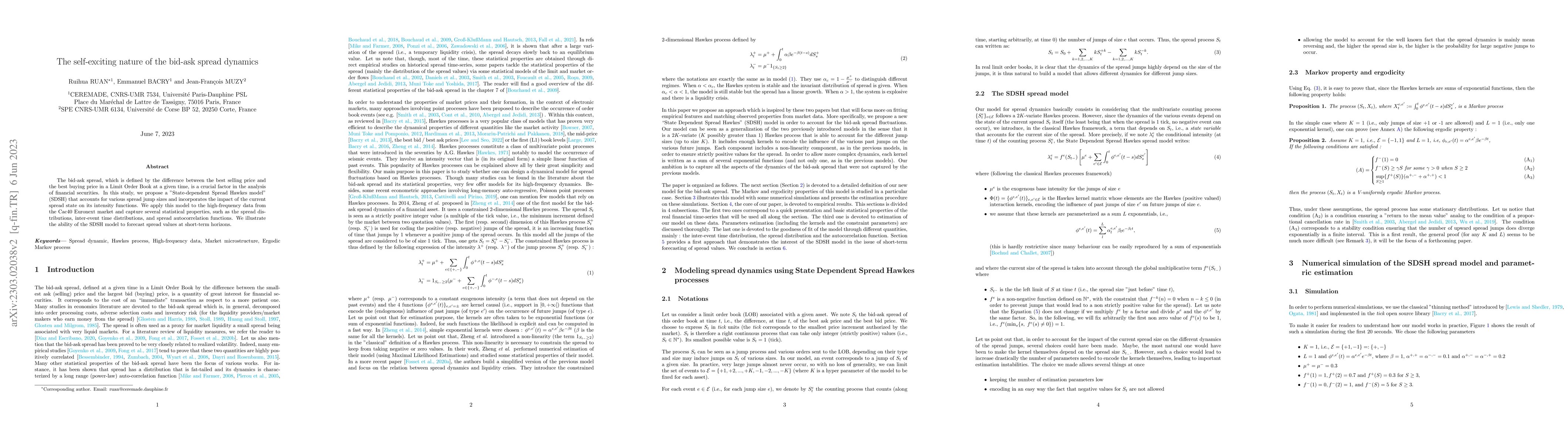

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)