Authors

Summary

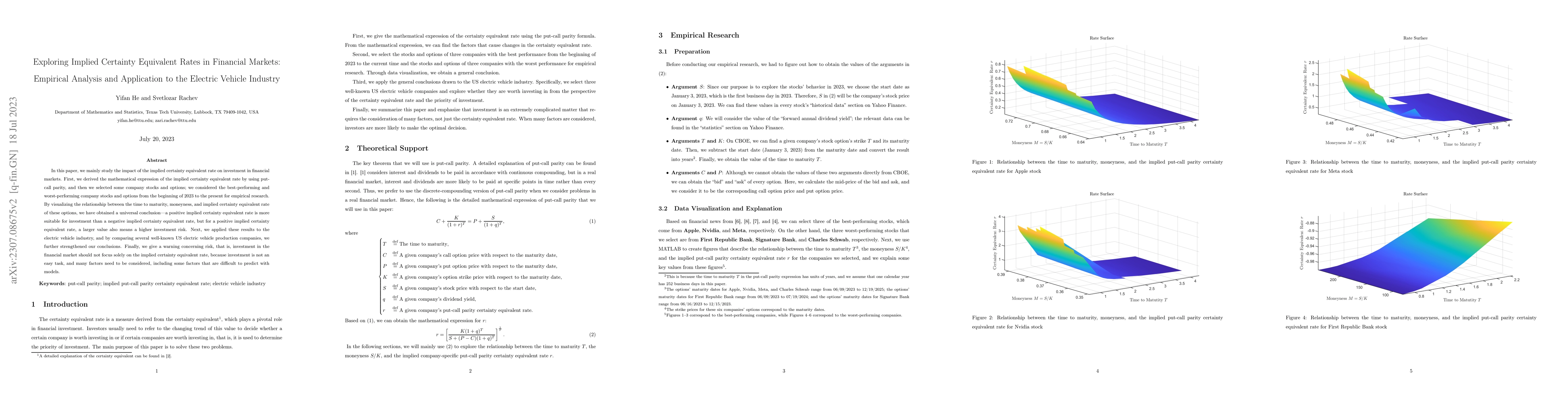

In this paper, we mainly study the impact of the implied certainty equivalent rate on investment in financial markets. First, we derived the mathematical expression of the implied certainty equivalent rate by using put-call parity, and then we selected some company stocks and options; we considered the best-performing and worst-performing company stocks and options from the beginning of 2023 to the present for empirical research. By visualizing the relationship between the time to maturity, moneyness, and implied certainty equivalent rate of these options, we have obtained a universal conclusion -- a positive implied certainty equivalent rate is more suitable for investment than a negative implied certainty equivalent rate, but for a positive implied certainty equivalent rate, a larger value also means a higher investment risk. Next, we applied these results to the electric vehicle industry, and by comparing several well-known US electric vehicle production companies, we further strengthened our conclusions. Finally, we give a warning concerning risk, that is, investment in the financial market should not focus solely on the implied certainty equivalent rate, because investment is not an easy task, and many factors need to be considered, including some factors that are difficult to predict with models.

AI Key Findings

Generated Sep 02, 2025

Methodology

The research derives the mathematical expression of the implied certainty equivalent rate using put-call parity, then applies it to analyze company stocks and options, including those from the electric vehicle industry.

Key Results

- A positive implied certainty equivalent rate is more suitable for investment than a negative one, indicating higher probability of returns.

- For positive rates, larger values correspond to higher investment risk.

- Best-performing companies have strictly positive implied certainty equivalent rates, while worst-performing ones have strictly negative rates.

- In the electric vehicle industry, Tesla, Ford Motor Company, and General Motors are recommended for investment based on their implied certainty equivalent rates, with Tesla being the top recommendation in the near future.

Significance

This research provides investors with a tool to evaluate stock options based on implied certainty equivalent rates, aiding in making informed investment decisions in both general financial markets and the growing electric vehicle industry.

Technical Contribution

The derivation and application of implied certainty equivalent rates using put-call parity to analyze stock options in financial markets and the electric vehicle industry.

Novelty

This paper uniquely combines the concept of implied certainty equivalent rates with empirical analysis of both traditional financial markets and the emerging electric vehicle sector, providing practical insights for investors.

Limitations

- The study does not account for all factors influencing investment, such as political events that can significantly impact stock prices.

- Implied certainty equivalent rate should not be the sole factor in investment decisions as it does not capture all market uncertainties.

Future Work

- Investigate additional factors that could enhance predictive accuracy of investment outcomes.

- Explore the incorporation of non-quantifiable elements like geopolitical risks into the investment decision-making model.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Multimodal Embedding-Based Approach to Industry Classification in Financial Markets

Rian Dolphin, Barry Smyth, Ruihai Dong

No citations found for this paper.

Comments (0)