Authors

Summary

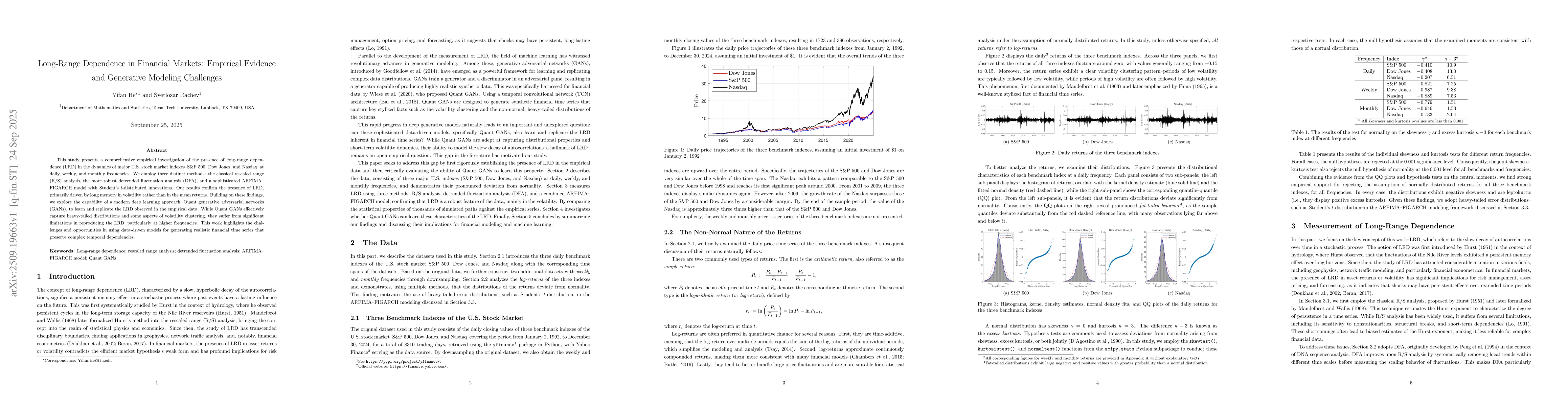

This study presents a comprehensive empirical investigation of the presence of long-range dependence (LRD) in the dynamics of major U.S. stock market indexes--S\&P 500, Dow Jones, and Nasdaq--at daily, weekly, and monthly frequencies. We employ three distinct methods: the classical rescaled range (R/S) analysis, the more robust detrended fluctuation analysis (DFA), and a sophisticated ARFIMA--FIGARCH model with Student's $t$-distributed innovations. Our results confirm the presence of LRD, primarily driven by long memory in volatility rather than in the mean returns. Building on these findings, we explore the capability of a modern deep learning approach, Quant generative adversarial networks (GANs), to learn and replicate the LRD observed in the empirical data. While Quant GANs effectively capture heavy-tailed distributions and some aspects of volatility clustering, they suffer from significant limitations in reproducing the LRD, particularly at higher frequencies. This work highlights the challenges and opportunities in using data-driven models for generating realistic financial time series that preserve complex temporal dependencies.

AI Key Findings

Generated Sep 28, 2025

Methodology

The study employed rescaled range (R/S) analysis, detrended fluctuation analysis (DFA), and ARFIMA-FIGARCH modeling to investigate long-range dependence (LRD) in financial markets. It also evaluated Quant GANs' ability to replicate LRD in synthetic financial time series.

Key Results

- LRD is present in S&P 500, Dow Jones, and Nasdaq returns across daily, weekly, and monthly frequencies, primarily driven by long memory in volatility.

- Quant GANs effectively capture heavy-tailed distributions and volatility clustering but fail to reproduce LRD, especially at higher frequencies like daily and weekly.

- ARFIMA-FIGARCH models confirmed LRD in volatility (dv ≈ 0.4) rather than mean returns, with significant dm values for most indices except Dow Jones daily returns.

Significance

This research highlights the challenges in generating synthetic financial time series that preserve complex temporal dependencies, with implications for risk management, portfolio optimization, and derivative pricing.

Technical Contribution

Development and evaluation of Quant GANs for financial time series generation, combining TCN architecture with domain-specific features to model sequential data with long-range dependence.

Novelty

First comprehensive empirical investigation combining multiple LRD analysis methods with deep learning-based synthetic data generation, revealing critical limitations in current models for capturing financial market dependencies.

Limitations

- Quant GANs struggle to replicate LRD in return series at higher frequencies, suggesting limitations in current deep learning frameworks for financial modeling.

- The study's focus on U.S. stock indices may limit generalizability to other markets or asset classes.

Future Work

- Enhancing temporal convolutional networks or adversarial training objectives to explicitly model long-range correlations.

- Exploring alternative measures of LRD to better assess synthetic data's ability to capture complex dependencies.

Comments (0)